Table of Contents:

- Step 1: Preparing your wallet

- Step 2: Understanding what you can do with your assets

- Step 3: What you actually do on Solana DeFi

- Conclusion

As the crypto world gears up for an exciting airdrop season on Solana, there's never been a more opportune time to familiarize yourself with the intricacies of Solana's decentralized finance (DeFi) landscape. Whether you're a novice navigating the crypto waters or a seasoned investor seeking new avenues, this guide is tailor-made for you. Join us as we embark on a journey through the dynamic realm of Solana's DeFi, exploring how you can not only secure your assets but also capitalize on the upcoming airdrop season for potential windfalls. Buckle up, as we guide you through the exciting universe of Solana's decentralized finance.

Step 1: Preparing your wallet

The first step in your journey into the Solana DeFi space is ensuring that you have your SOL securely stored in a compatible wallet. Popular choices include the user-friendly Phantom or the versatile Backpack wallet. Make sure your wallet is well-protected, as security is paramount in the world of cryptocurrencies. It is best to set up different wallets for different purposes to prevent risks of malicious actions. We would recommend the set-up of wallets as follows:

- Hot Wallets (Phantom, Backpack, Solflare): the day-to-day wallets in use. Make sure you only have adequate resources on these wallets. It’s best to set up multiple hot wallets in relation to the projects you’re interacting with.

- Cold Wallets (Streamflow, Squads): The place where you store your valuable assets. You should not connect this wallet to ANY sites. This is the safest way to protect your asset while you’re still going on your on-chain journey.

- Burner Wallets: You can use this to connect to sites, to check if they are legit or not. Don’t leave any funds in this wallet for safety purposes.

Step 2: Understanding what you can do with your assets

Now that you have successfully set up your wallet, let's explore the concept of assets and the potential for generating passive income. In the realm of DeFi, assets represent more than just a store of value – they can be utilized to generate passive income through various mechanisms. The key is to put your assets to work for you.

It is safe to say that we are at the very beginning of a new Solana DeFi age. By sustaining a vibrant DeFi ecosystem, users can have multiple options in which they can lend, borrow, and stake from inside the ecosystem. By participating in these activities, you can earn rewards and contribute to the liquidity and efficiency of the network.

Step 3: What you can actually do on Solana DeFi

Now, let's dive into the exciting possibilities that Solana's DeFi landscape presents:

Staking

Staking SOL in the burgeoning Solana ecosystem has become a cornerstone for crypto enthusiasts seeking both stability and substantial returns. The landscape is rich with variety, and as money continues to flow into the ecosystem, three standout staking protocols have captured the spotlight.

-

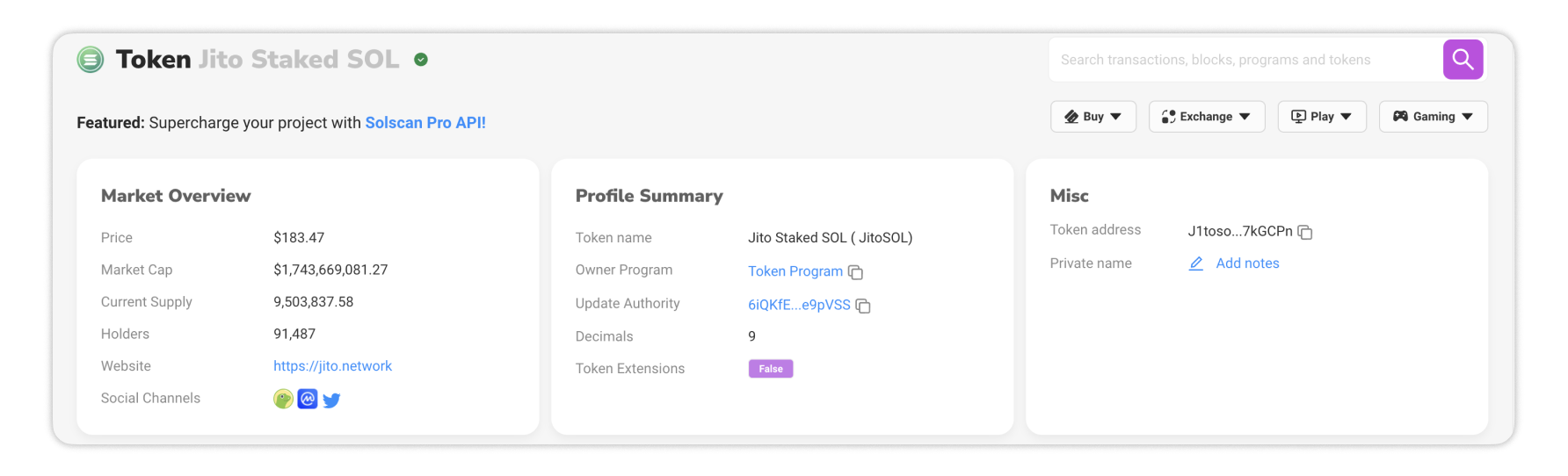

Jito - Maximizing Extractable Value (MEV) Rewards:

One of the pioneers in the liquid staking space, Jito offers Solana holders the opportunity to stake their tokens and partake in the distribution of Maximum Extractable Value (MEV) rewards. This innovative approach adds an extra layer of value to traditional staking, making it an enticing option for those looking to maximize their returns while actively participating in the Solana network. By staking your SOL with Jito, Jito exclusively stakes with validators that run software designed to improve network performance.

-

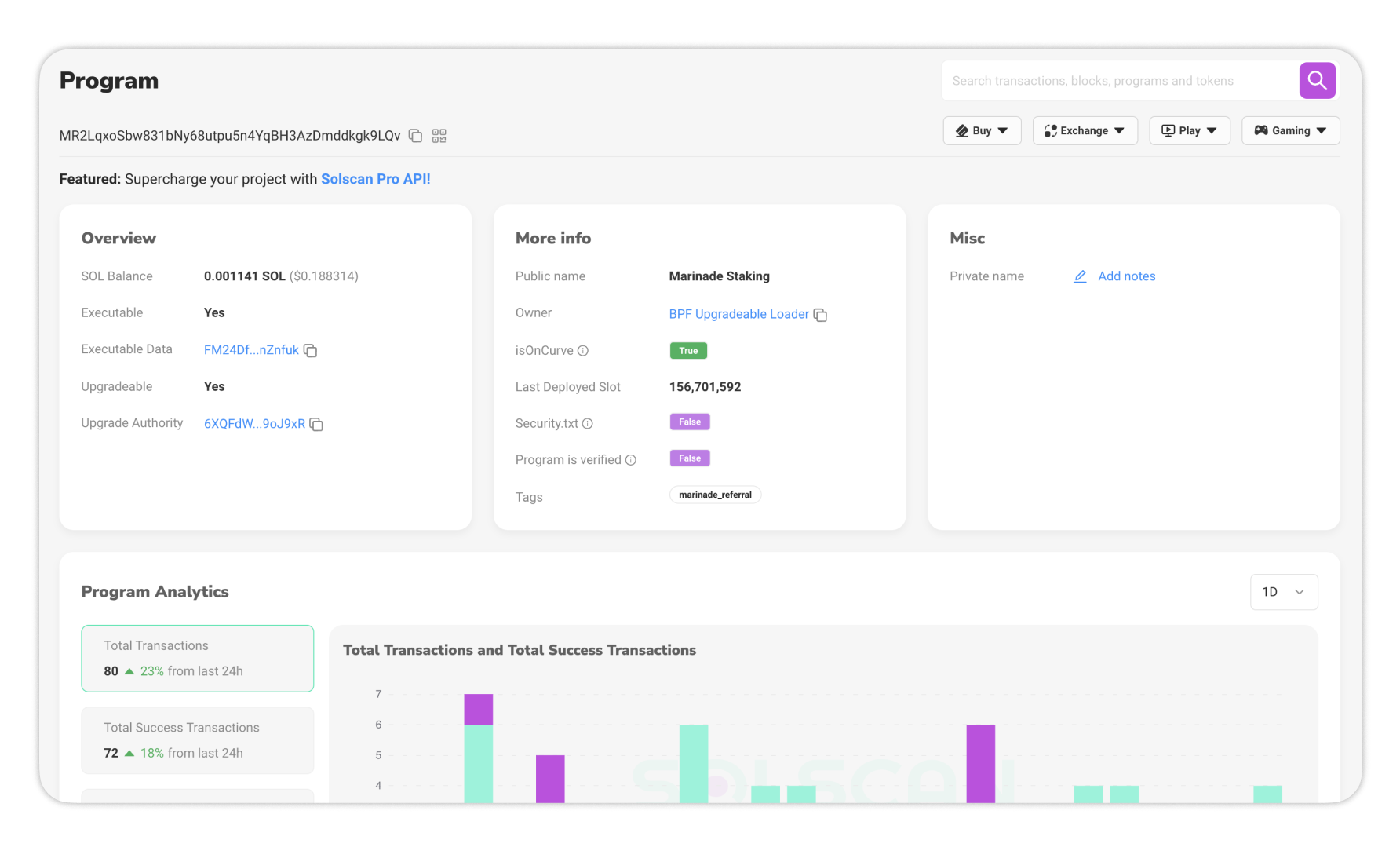

Marinade - A dual approach to staking

Marinade stands out by providing users with the flexibility to choose between staking natively or opting for liquid staking with mSOL, a liquid staking token. This dual approach ensures that users can tailor their staking strategy to align with their specific preferences and risk tolerance. The result is a versatile and user-friendly staking experience that caters to a broad audience.

-

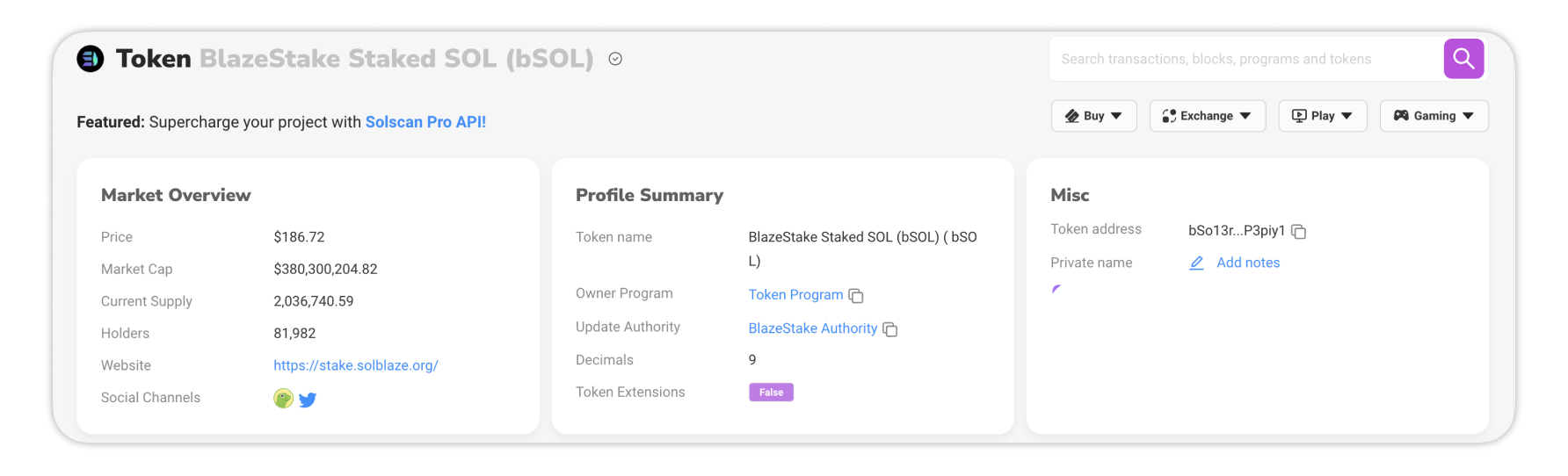

SolBlaze - The foundation-supported staking protocol

SolBlaze takes staking a step further as a fully non-custodial Solana stake pool protocol supported by the Solana Foundation. By staking SOL through BlazeStake, users receive BlazeStake Staked SOL (bSOL) tokens, adding an additional layer of utility. These bSOL tokens can be seamlessly integrated into various DeFi applications, unlocking new avenues for earning and engagement within the Solana ecosystem.

Leveraging DeFi Protocols for Maximum Returns

Once you've staked your SOL, the journey doesn't end there. The next logical step is to take advantage of different DeFi protocols to maximize opportunities and rewards.

-

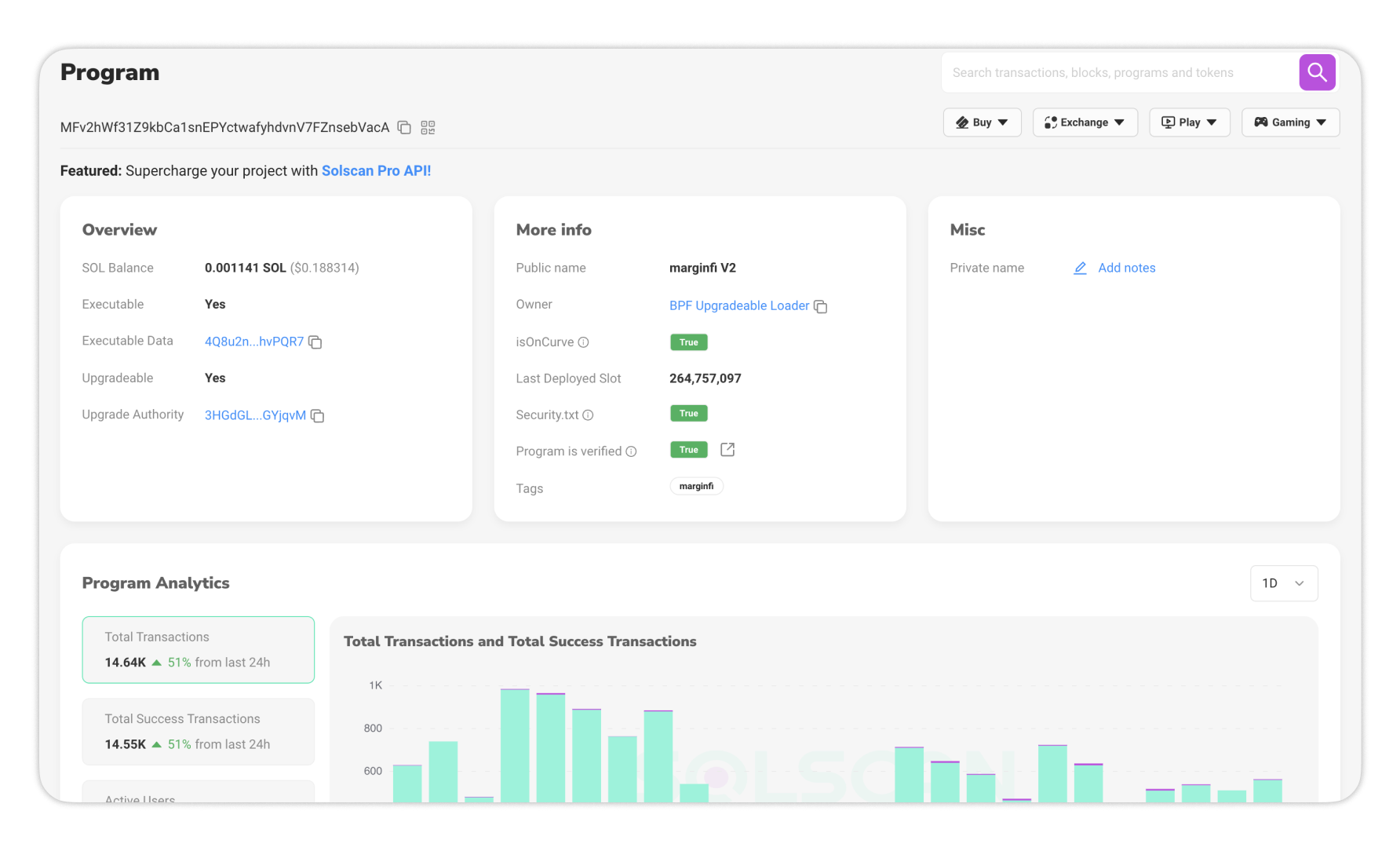

Marginfi

Enter Marginfi, a decentralized lending protocol prioritizing risk management, providing a secure solution for users seeking leverage and capital efficiency.

-

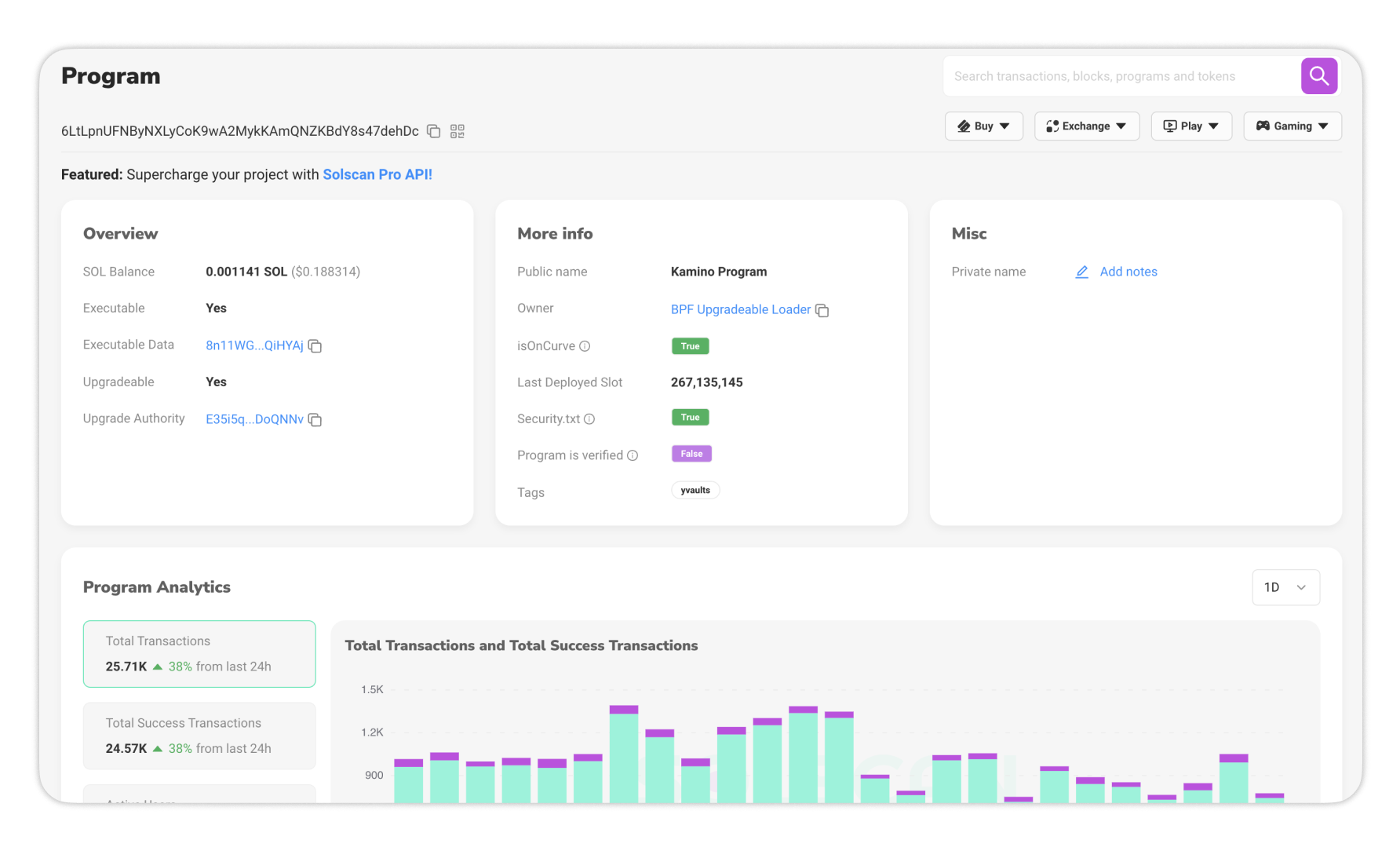

Kamino Finance - Unifying Lending, Liquidity, and Leverage

For those looking to consolidate their DeFi activities, Kamino Finance offers a groundbreaking solution by unifying lending, liquidity provision, and leverage into a single, secure product suite. This innovative protocol streamlines the DeFi experience, allowing users to efficiently manage their assets while tapping into various financial instruments.

Trading and Earning More with Solana DEXes

The final frontier in this comprehensive strategy involves taking your staked assets, rewards, and borrowed tokens into different decentralized exchanges (DEXes) on Solana. Platforms like Zeta, Drift, Backpack, and Jupiter offer vibrant ecosystems for trading, allowing users to not only earn more but also contribute to the network effect of Solana's DeFi protocols.

Conclusion

To sum up, Solana's DeFi landscape is a playground of opportunities for those willing to explore and engage. By following these steps, you not only maximize your passive income but also contribute to the growth and efficiency of the decentralized financial ecosystem on the Solana blockchain. So, strap in and get ready to elevate your crypto journey to new heights!