Stablecoins and real‑world assets show blockchain is being exported into reality as much as reality itself goes on chain.

Over the past few weeks, discussions about crypto’s role as a commodity have intensified. Gold surged, outpacing major cryptocurrencies. While price volatility is familiar territory for long-time crypto participants, the more important story is how infrastructure keeps pace with these market swings.

This post surveys recent news in two key areas: the evolution of stablecoin products and the growing space of real‑world assets (RWAs). In each, we see hints of a deeper philosophical shift: Blockchain is entering the “real world” as much as the world is going on chain.

This framing may sound playful, but it has real implications. As blockchain rules move beyond the chain, they begin to overlap with, and in some cases challenge, existing financial models.

Let’s consider two examples of this trend in stablecoins specifically and in real-world assets (RWAs) more generally. Both have seen some major events already this year.

1. Stablecoins and Market Structure

“Stablecoin,” as a label, is a misnomer. They are not always stable, and when they are stable they are not stable for the same reasons. In a prior Etherscan post, we covered how stablecoins should be thought of as distinct products with widely varying properties.

In general terms, stablecoins are currency-pegged products. Through stablecoins, currencies have entered the chain and now represent a major use case. According to a recent Alchemy analysis, there are over $300 billion (USD) in stablecoins represented on blockchain. Most of this value is pegged to the US dollar dominated by two popular products (USDT and USDC). Other currencies are also represented, including the euro through EURC.

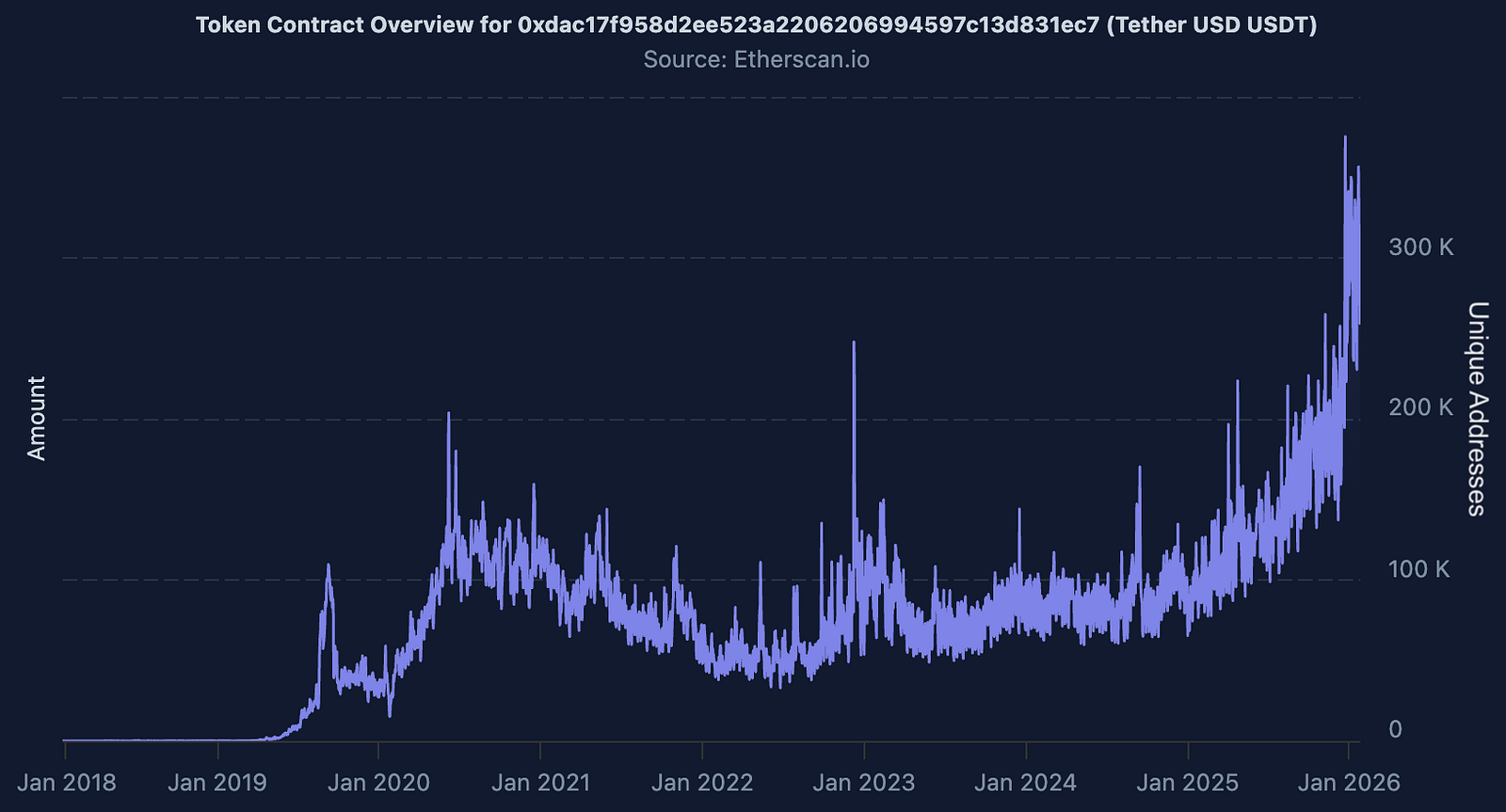

Tether’s USDT now has hundreds of thousands of transacting addresses per day on Ethereum mainnet alone.

From the rise of stablecoins, a new financial model has emerged: Stablecoins are now among the most prominent assets that operate on borrower‑lender collateral frameworks — essentially fully transparent leveraged systems.

Consider DAI, a long-standing USD‑pegged stablecoin issued by Sky (formerly MakerDAO). Because it is fully on-chain and programmable, DAI can be seamlessly integrated into other DeFi platforms, where it can be used for lending, earning yield (interest), trading, or as collateral for borrowing. (Note: USDS is now the upgraded version under Sky’s rebrand.)

This yield property of the ledger is familiar in traditional finance, but its strength on chain is its various assurances. These include decentralized governance, continuous public auditability, 24-hour operation, rich programmability and more. This is unique to a digital, decentralized “unstoppable” public ledger. We can visit Etherscan and browse the activity of DAI across more than 600,000 holding addresses.

Many have noticed this potential influence from the chain. The IMF recently warned that stablecoins may put competitive pressure on the traditional system.

This trend is more than just moving currencies to the chain. It’s an export of blockchain to reality: A blockchain-based product model is porting into and competing with elements of reality.

This digital-to-real export has brought it attention in recent US government news. US Congress is considering legislation on a market structure bill, defining crypto jurisdictions, oversight, and various regulations.

(This legislation is distinct from the GENIUS Act, which passed July 2025. GENIUS specified stablecoin definitions, requirements, and regulations around currency or equivalent reserves.)

The new market structure bill has several controversial properties, among them restricting interest yield in stablecoin products, mentioned above. Coinbase CEO Brian Armstrong recently announced concern about the bill. His post garnered considerable attention on X. The bill is still under consideration, negotiations continuing as of this writing.

After reviewing the Senate Banking draft text over the last 48hrs, Coinbase unfortunately can’t support the bill as written.

— Brian Armstrong (@brian_armstrong) January 14, 2026

There are too many issues, including:

- A defacto ban on tokenized equities

- DeFi prohibitions, giving the government unlimited access to your financial…

Stablecoin activity continues to expand as more financial institutions adopt them. Just recently Fidelity, one of the largest fund managers in the world, announced a new stablecoin pegged to the US dollar and its new FIDD coin will be hosted on Ethereum mainnet.

FIDD also illustrates exports from the chain: FIDD will not simply represent US dollars on the chain, it is planned as a new financial product also available to everyday retail investors with features including daily disclosures of issuance.

Fidelity announced FIDD’s official release just moments ago:

We are excited to introduce Fidelity Digital Dollar (FIDD), a new stablecoin issued by Fidelity Digital Assets, NA and pegged 1:1 to the U.S. dollar.

— Fidelity Digital Assets (@DigitalAssets) February 4, 2026

Learn more and get started with FIDD: https://t.co/VlsKPR2BFY pic.twitter.com/wnOnXCRO03

2. Real-World Assets

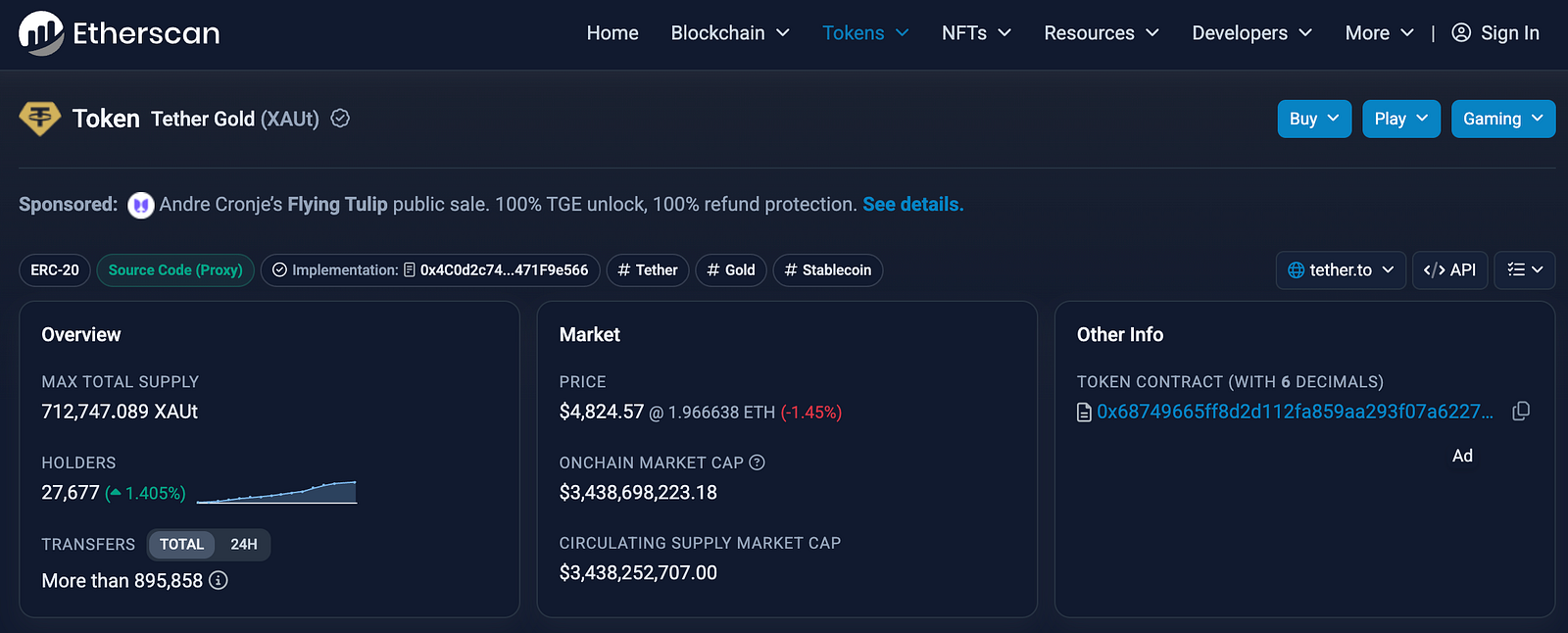

Real-world assets (or “RWAs”) are commodities or other objects of value in the “real world” that are in some way indexed on chain for trading, provenance, and more. Stablecoins are the most common RWA. As noted above, Tether hosts the most prominent stablecoin (USDT), but it also hosts the most dominant RWA commodity: Tether Gold (XAU₮).

Tether reports XAU₮ having over $2 billion in USD-equivalent market capitalization. Its Jan. 2026 reserves report breaks down the number of gold bars it contains. In total, Tether’s custodian holds over 16 tons (520,089 “troy ounces” of gold). Investors can gain exposure to this commodity by purchasing this ERC-20 on chain (though registration is required).

As noted above, recent market turbulence has brought volatility in gold and silver, which have seen major swings up (and recently down) in response to these market conditions. Many commented on how these commodities changed in value more quickly than crypto. Yet an important observation is that the commodity itself is also on chain.

Together with Paxos Gold (PAXG) these two Ethereum digital assets represent the majority of commodity RWAs represented on chain. According to analysis by RWA.xyz, Ethereum dominates in the representation of RWAs.

RWA.xyz offers an excellent survey of real-world assets represented on chain, across a number of categories including stablecoins, treasuries, commodities and more.

Another key development in the RWA space is the on‑chain representation of equities (stocks, etc.). There are many illustrations of this including the Canton Network and Ondo. In June 2025 Robinhood deployed tokenized equities on the Arbitrum network with a plan to build their own future L2 network. You can already peruse deployment of tokenizations on Arbiscan.

The biggest recent news on this front is the announcement by the New York Stock Exchange (NYSE) that they will be porting stock trading activity onto the chain (equities and ETFs).

Today, NYSE is proud to announce the development of a platform for trading and on-chain settlement of tokenized securities.

— NYSE 🏛 (@NYSE) January 19, 2026

NYSE’s new digital platform will enable tokenized trading experiences, including 24/7 operations, instant settlement, orders sized in dollar amounts, and…

This announcement is also suggestive of a digital export to reality: The chain is entering the world. It is not just representation of assets on a digital, decentralized ledger. Instead, the chain is exporting its own unique properties for others to use: instant settlement, 24/7 operation, stablecoin based and more.

There is speculation regarding which chain will support the NYSE’s infrastructure, but their announcement notes that it will include “the capability to support multiple chains for settlement and custody.”

Digital Exports to Reality

Investor Eric Weinstein once reported his initial excitement about blockchain, noticing that “…someone figured out how to port the constraints of the physical world into the digital layer.” He was referring to Bitcoin and how its properties use mathematics to emulate certain features of reality.

There are now many ways to “port reality” into the chain.

Consider transfer of NFTs. In the real world, when a physical object passes between one person and another it has a sort of raw finality. In its barest form, possession is assured by the laws of physics: The object was in your hand, now it’s in mine. In blockchain, there’s a similar discrete finality. NFT possession is assured by consensus and its cryptography.

Weinstein’s analogy runs one way: physical reality into the chain.

But this relationship between real and digital can flow in both directions. Those who are passionate about cryptographically-secured ledgers and their programmable properties are inspired by the reverse direction: blockchain ported into physical reality.

We can imagine a kind of epic digital-to-reality duel that is depicted in films like The Thirteenth Floor and more recently Tron: Ares. In Tron: Ares, digital programs port into reality, gain some level of conscious awareness (with morality to boot) and battle megacorps. Sounds eerily familiar.

This playful plot device has real analogs, as we’ve reviewed above.

The recent advances in stablecoins and real‑world assets (RWAs) suggest that decentralized finance is indeed spilling over into everyday life. While the technology behind these instruments has long lived on blockchain, we are now seeing further trends in which on‑chain logic is increasingly being applied to real‑world contexts.

The future is strange and exciting.

—

Takens Theorem is on X. He was not paid for this post. He enjoyed writing it. He sometimes owns things he mentions, such as some ETH and such.