Ethereum staking has come a long way since the network's transition to proof-of-stake (PoS) with The Merge on September 15, 2022. As the network grows, so do the challenges of scalability, efficiency, and flexibility in staking. The upcoming Pectra upgrade, expected in early April 2025, introduces key improvements to address these issues, making it easier and more efficient for both large-scale and individual stakers to participate.

3 Ethereum Improvement Proposals (EIPs) in Pectra bring significant enhancements: increasing validator effective balances, reducing validator activation times, and improving withdrawals flexibility. These upgrades aim to streamline staking operations, reduce network overhead, and provide stakers with greater control over their funds.

We explore how these changes help improve the staking experience, long-term security and usability of Ethereum.

Key Staking Improvements in Pectra

1) Larger Validator Effective Balances (EIP-7251)

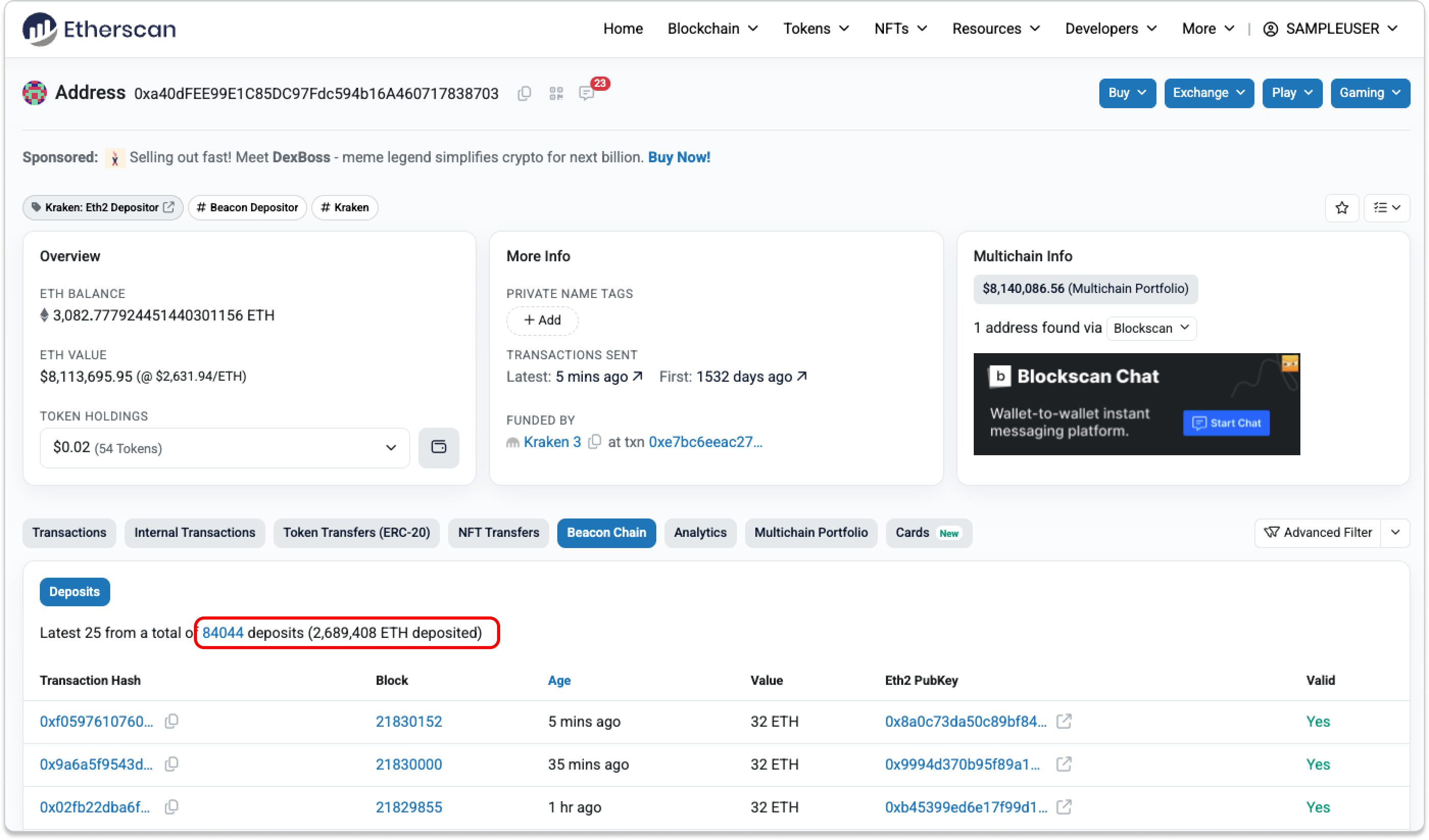

Ethereum’s staking model currently enforces an effective balance limit of 32 ETH per validator, meaning that large-scale stakers must distribute their ETH across multiple validator instances. This approach was originally designed to encourage broad participation from the community and ensure sufficient cryptographic signatures to secure the early Beacon Chain.

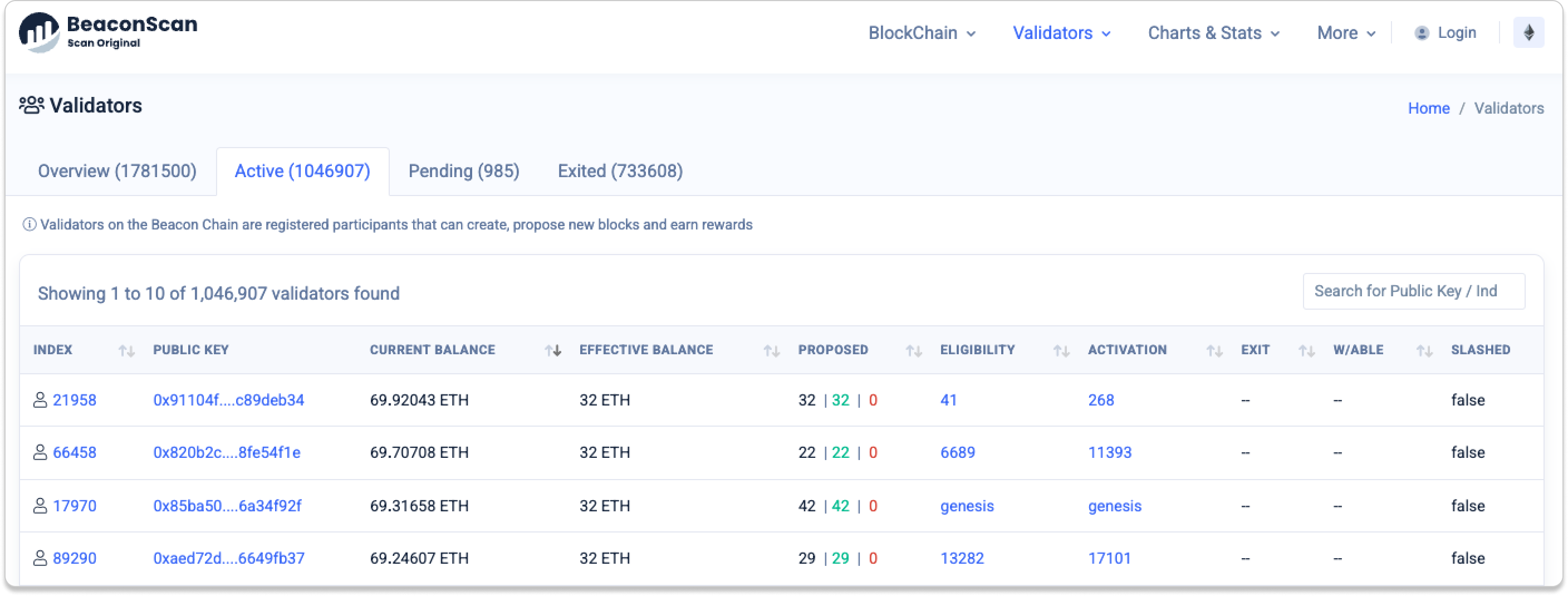

However, as staking demand has grown, the 32 ETH cap has introduced inefficiencies, adding unnecessary operational complexity and network overhead. Simulations conducted by Ethereum Foundation engineers suggest that Ethereum’s networking layer begins to struggle beyond 1.4M validators, despite earlier estimates suggesting a theoretical limit of 4.1M.

By raising the effective balance limit to 2,048 ETH per validator while maintaining the 32 ETH minimum staking requirement, EIP-7251 aims to:

- Improve efficiency: Large stakers can consolidate their ETH into fewer validators, simplifying operations and reducing redundant infrastructure.

- Reduce network strain: A smaller validator set size (currently 1.04M) reduces the number of P2P messages over the network, thereby lessening the burden on Ethereum’s consensus layer, helping to mitigate networking issues.

- Increase flexibility: Individual stakers starting with 32 ETH can benefit from compounding rewards and stake in smaller, more flexible increments, rather than needing another full 32 ETH to earn additional rewards.

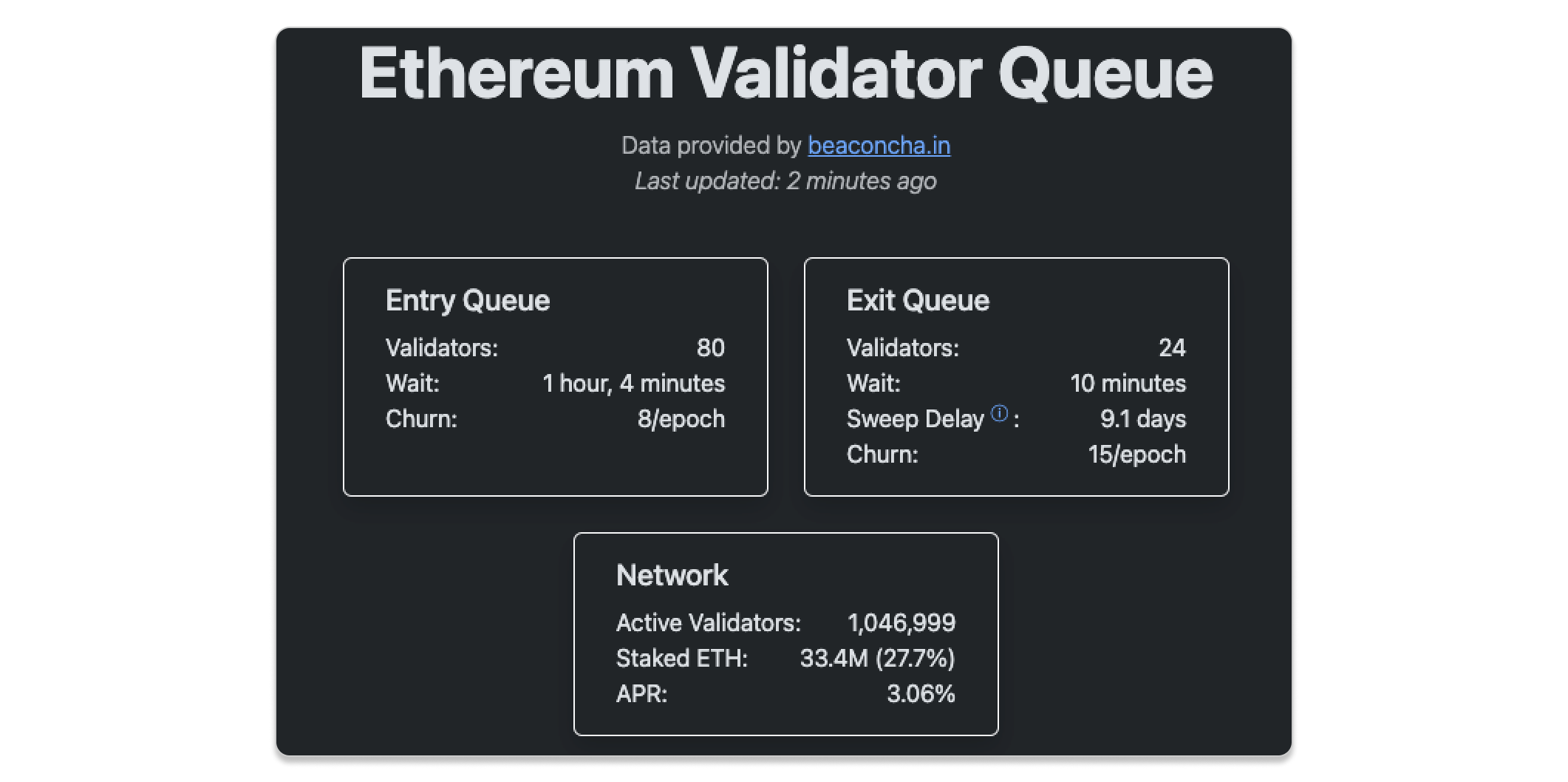

2) Shorter Validator Activation Times (EIP-6110)

EIP-6110 aims to simplify and speed up the process of becoming a validator. Currently, when someone wants to become a validator, they deposit 32 ETH, but due to the current system's design, there's about a 12-hour wait before they become an active validator, assuming no validator queue exists. This delay is because the Consensus Layer (which ensures all validators agree on the state of the blockchain) relies on a method called proposer voting to process these deposits.

With an activation queue of 1hour 4 minutes (at time of writing), the total time for a validator to become active is ~12 hours (deposit inclusion delay) + 1 hour 4 minutes = ~13 hours 4 minutes.

EIP-6110 proposes moving the handling of these deposits directly to the Execution Layer (which processes transactions and smart contracts). By doing this, it removes the need for proposer voting, making the system simpler and more secure. A significant benefit of this change is that the waiting time for a new validator to become active would drop from around 12 hours to just about 13 minutes.

After EIP-6110, the total time taken for validator activation would be ~13 minutes (deposit processing) + 1 hour 4 minutes (activation queue at time of writing) = ~1 hour 17 minutes.

Shorter activation times mean users can respond more quickly to market changes, such as fluctuations in staking rewards, shifts in ETH price, or changes in network participation. If staking rewards rise, users can activate validators faster to maximize returns. Conversely, if many validators exit during market downturns, quicker activation allows new participants to replace them, preventing disruptions in Ethereum’s security and consensus.

3) More Flexible Full & Partial Withdrawals (EIP-7002)

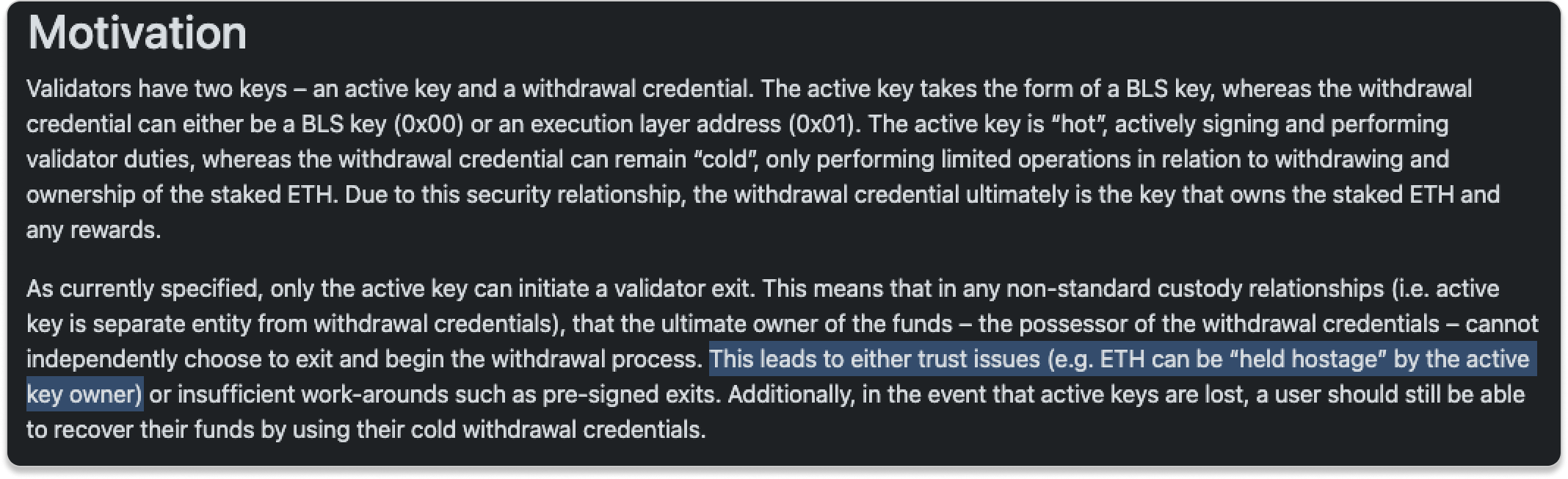

EIP-7002 is an Ethereum proposal designed to simplify and enhance the security of the staking withdrawal process. Currently, validators possess two types of keys: an active key for daily network operations and a withdrawal key that controls access to their staked ETH.

However, only the active key can initiate the withdrawal process, creating potential issues if it is lost, compromised, or held by a separate entity from the withdrawal key owner. In cases where node operators (who control the active key) manage staking on behalf of stakers (who hold the withdrawal key), stakers must rely on them to process withdrawals.

To illustrate, consider Alice, who wants to stake her ETH but lacks the technical skills to run a validator. She delegates this task to Bob, a node operator. Under this arrangement, Alice retains the withdrawal key, ensuring ownership of her staked ETH, while Bob holds the active key, required for validation duties.

Currently, if Alice wishes to fully withdraw funds, Bob must sign and submit a Voluntary Exit Message (VEM) using his active key. If Bob becomes uncooperative, unreachable, or malicious, he can refuse to sign the VEM, preventing Alice from withdrawing her ETH. This reliance introduces a trust assumption in staking as a service setups.

EIP-7002 addresses this issue by allowing the withdrawal key to initiate validator withdrawals independently. Post-EIP-7002, Alice will be able to trigger the exit process herself, without relying on Bob. This change also complements EIP-7251, by allowing stakers who opt for a higher effective balance to initiate partial withdrawals on their own.

Additionally, EIP-7002 allows smart contract accounts to be set as withdrawal credentials. This unlocks new possibilities for validators to implement social recovery, automate withdrawal processes, integrate with decentralized applications, etc.

For a deeper understanding of this EIP, refer to the detailed analysis at EIP-7002: Unpacking Improvements to StakingUX Post-Merge.

Conclusion

The Pectra upgrade introduces key improvements to the staking experience, long-term security, and usability of Ethereum as a proof-of-stake network.

However, the full impact of these upgrades remains to be seen. Ethereum’s transition from a validator-count-based system to one based on aggregated balances (32–2,048 ETH per validator) raises questions about how validator rewards, penalties, and withdrawals will evolve. Additionally, EIP-7002 could pave the way for more trustless and user-friendly staking applications.

Slated for early April 2025, Pectra is Ethereum’s largest upgrade to date, incorporating 11 EIPs that extend beyond staking enhancements. For a simplified overview of the other EIPs in Pectra, check out this thread:

here’s what’s in the pectra upgrade:

— binji (@binji_x) January 1, 2025

-2537: bls12-381 precompiles

-2935: historical block hashes in state

-6110: validator deposits on-chain

-7002: triggerable exits

-7251: raise max effective balance

-7549: streamline validator voting

-7623: calldata cost adjustments

-7685:…