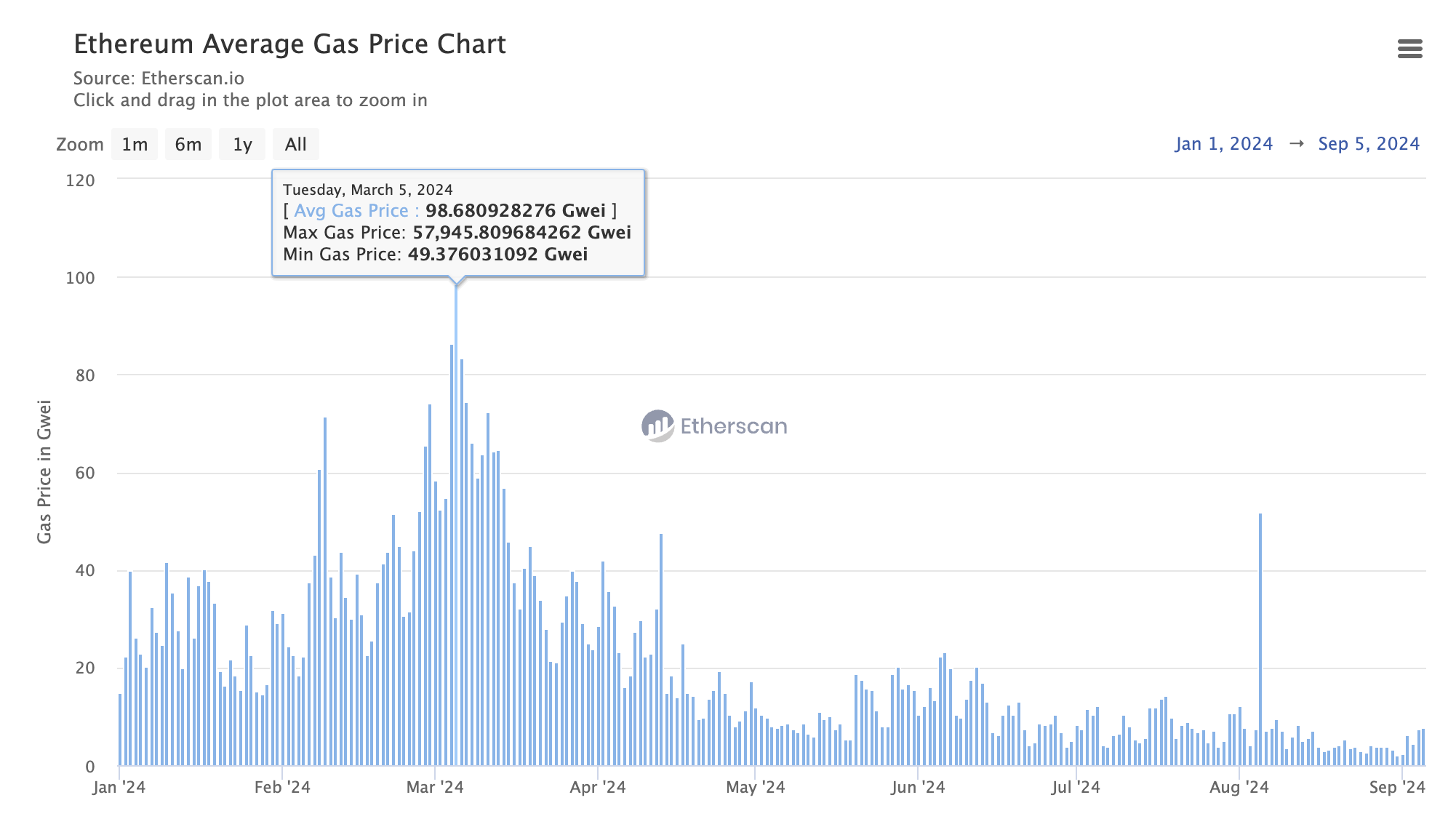

If you frequently transact on Ethereum, you may have noticed the sustained low gas prices in recent weeks. As shown in the chart below, the average gas price has steadily declined since its 2024 peak of 98.68 gwei on March 5.

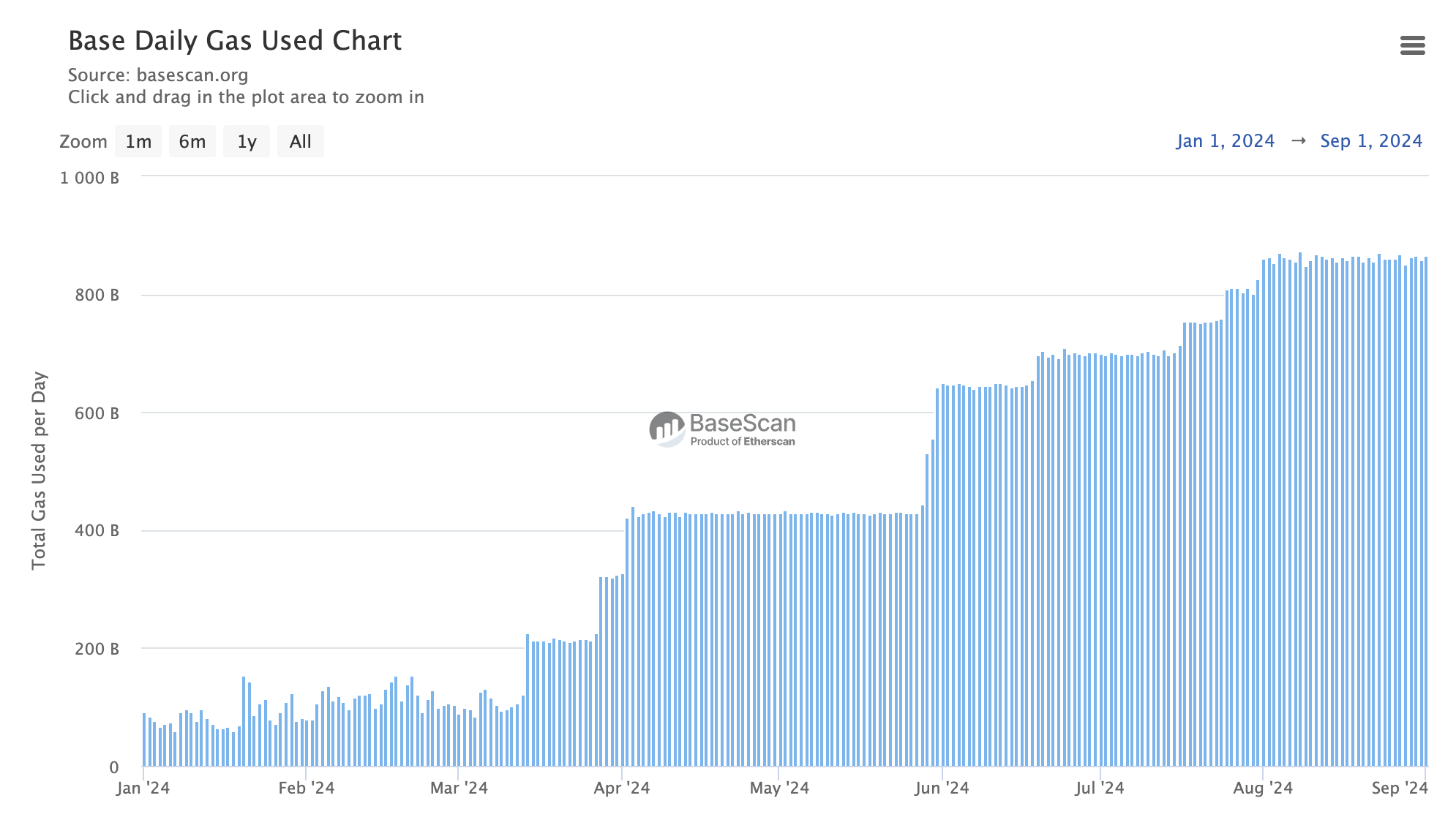

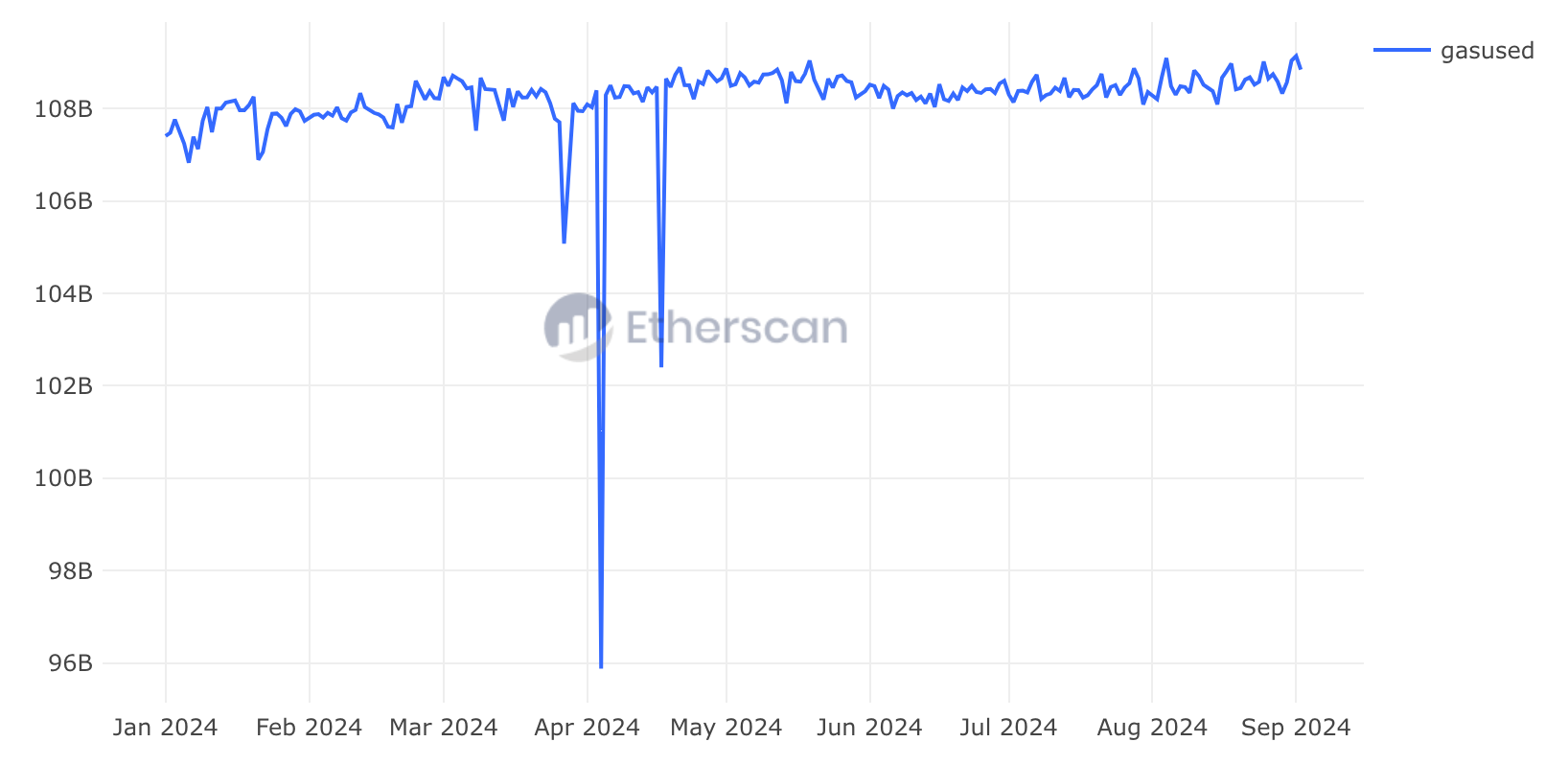

Since gas prices generally follow demand, one might assume a drop in demand for Ethereum's block space. However, daily transaction counts remain within the same range as in January 2024, when gas prices were more than five times higher. Additionally, the daily gas used chart shows no downtrend; in fact, September 1st recorded the highest daily gas usage in 2024.

This suggests that the simple assumption—lower gas prices indicate lower demand—doesn't fully explain the situation. In this article, we’ll explore the nuances and other factors contributing to the sustained low gas prices.

Drop in Consistent Block Space Demand Post-Dencun

A key catalyst for the recent downtrend in gas prices is the EIP-4844 Proto-Danksharding upgrade, designed to reduce fees when L2s commit data to Ethereum. Here's a quick comparison of Ethereum data before and after the Dencun upgrade:

Did you know? 🤔

— Etherscan (@etherscan) March 22, 2024

The Dencun upgrade was activated last week on March 13th at 13:55 UTC, introducing proto-danksharding aimed at reducing fees when L2s commit data to Ethereum

Quick comparison of Ethereum data before & after Dencun 🧵

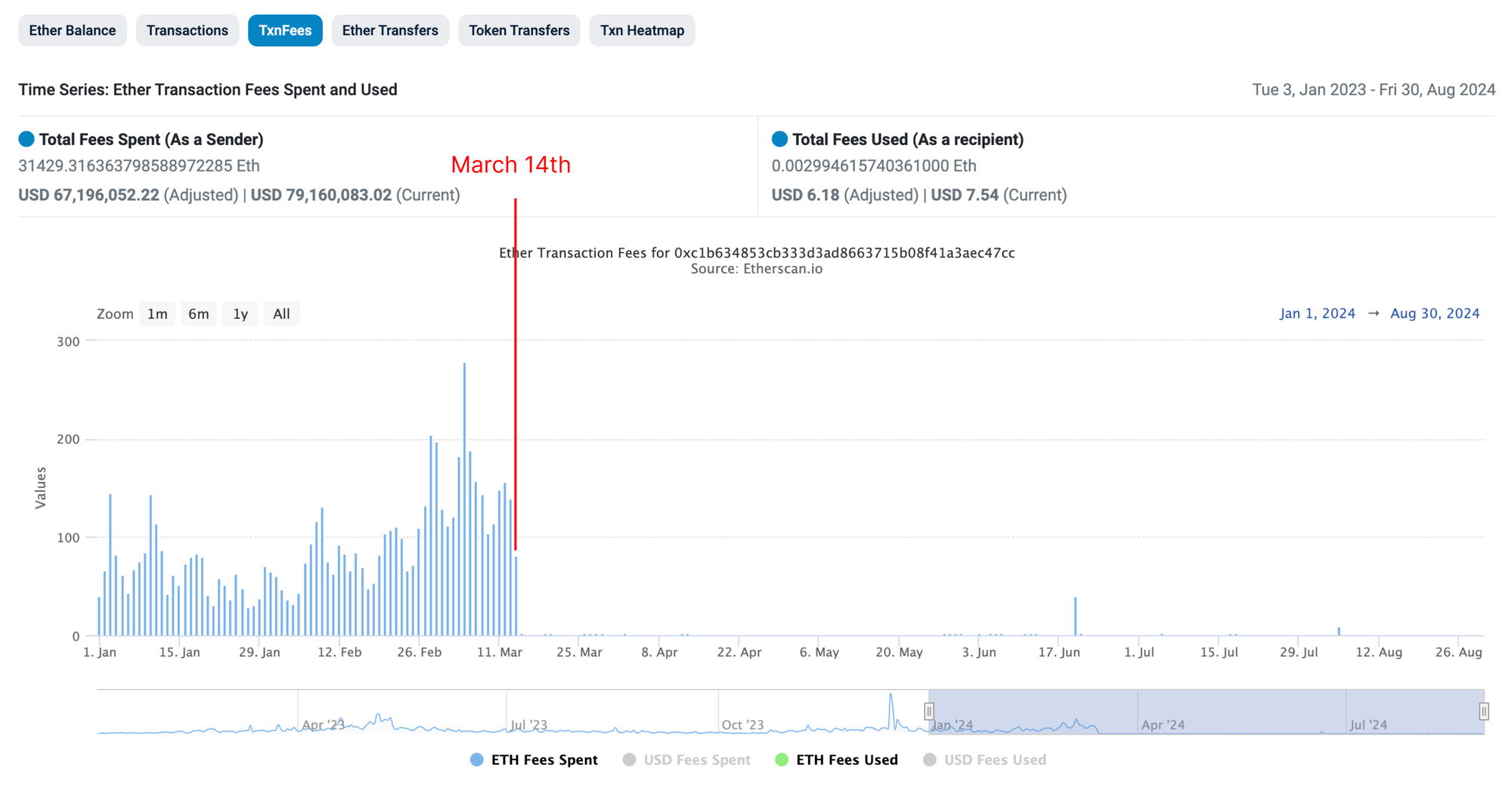

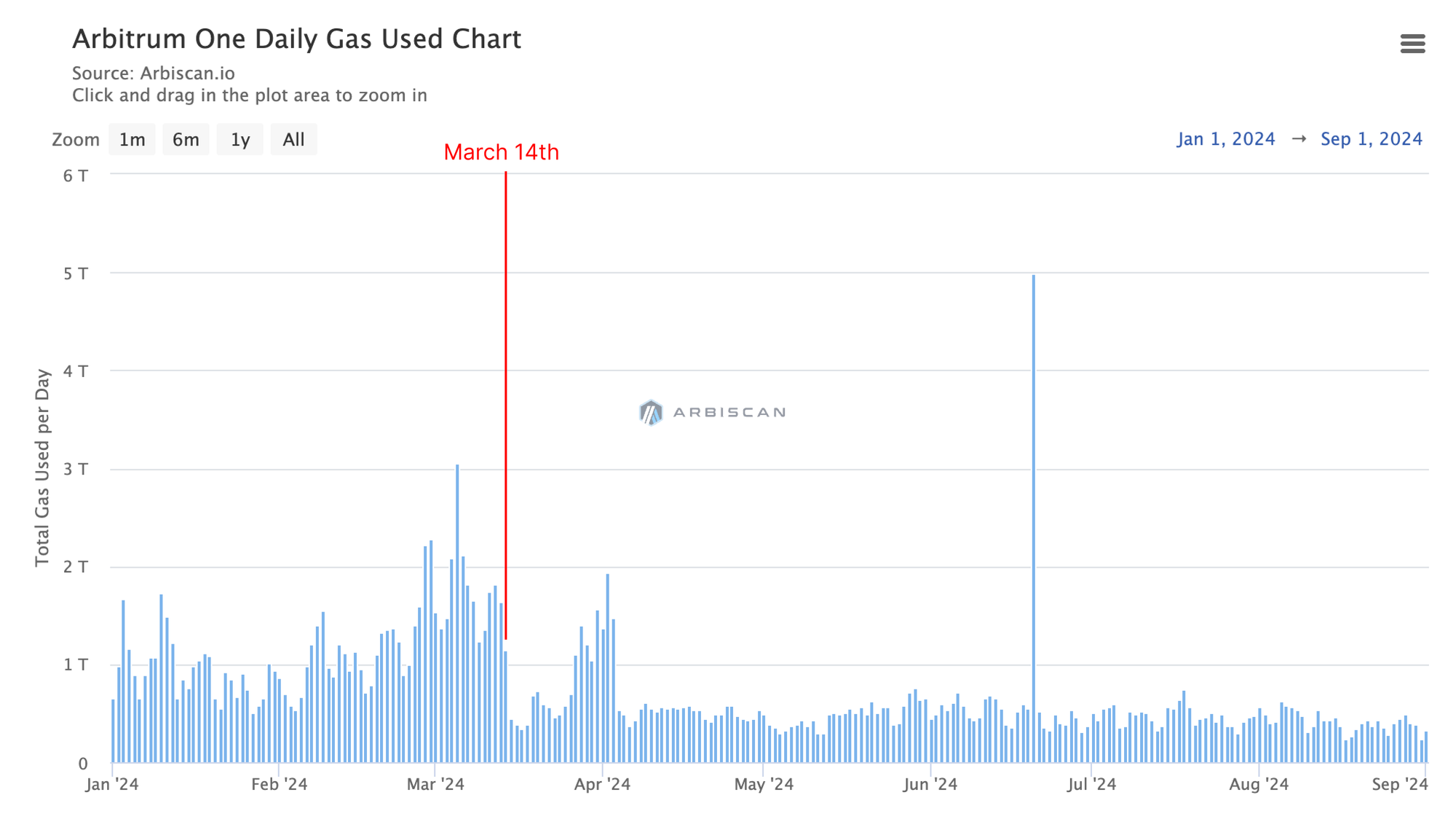

7 days before the upgrade, the address labeled "Arbitrum: Batch Submitter" was the top gas spender on Ethereum, paying over 100 ETH in fees while daily gas usage on Arbitrum One exceeded 1T. Increased gas usage on Arbitrum led to higher fees paid on Ethereum.

After the upgrade, however, Arbitrum consistently paid single-digit ETH fees. Even when Arbitrum One's gas usage spiked to nearly 5T on June 20th during LayerZero's token airdrop, the fees paid on Ethereum were just 39.82 ETH.

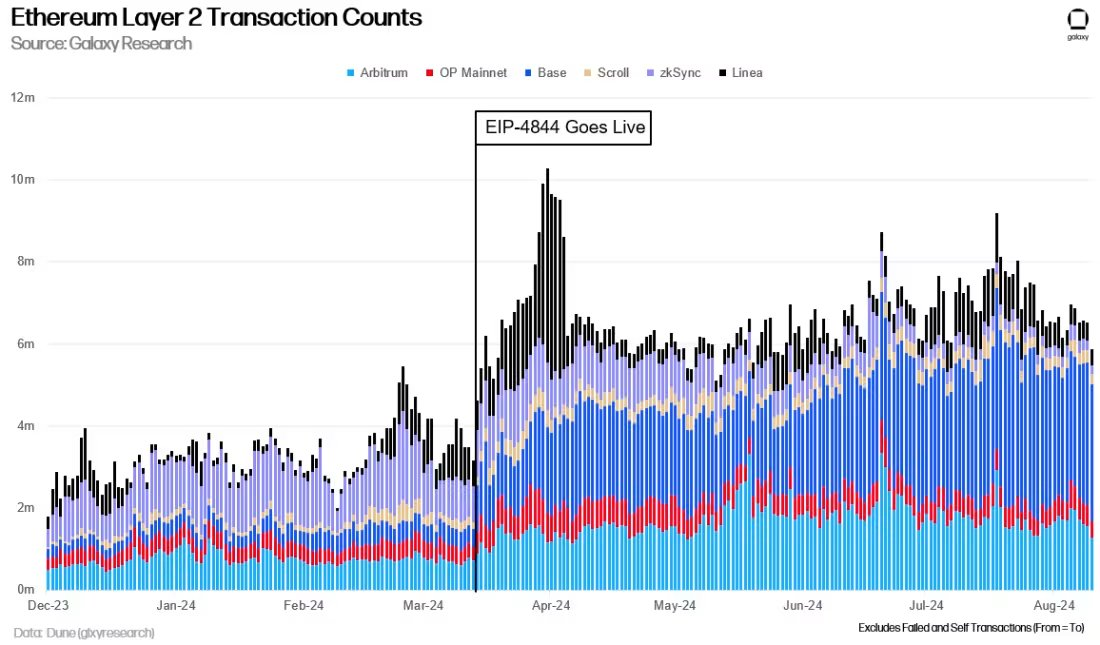

EIP-4844 introduced a separate fee market for L2s to post blobs on Ethereum, alleviating much of the consistent demand for Ethereum block space. As these fee savings are passed down to L2 users, activity on leading L2s surged post-Dencun.

Since more gas usage on L2s no longer directly increases fees on Ethereum, Base increased its block gas limit multiple times post-Dencun, with even more gas target increases to achieve the goal of 1 Ggas/s capacity, aiming to further reducing fees for Base users. Currently, Base can batch 171,866 transactions while paying only $1.61 in L1 fees.

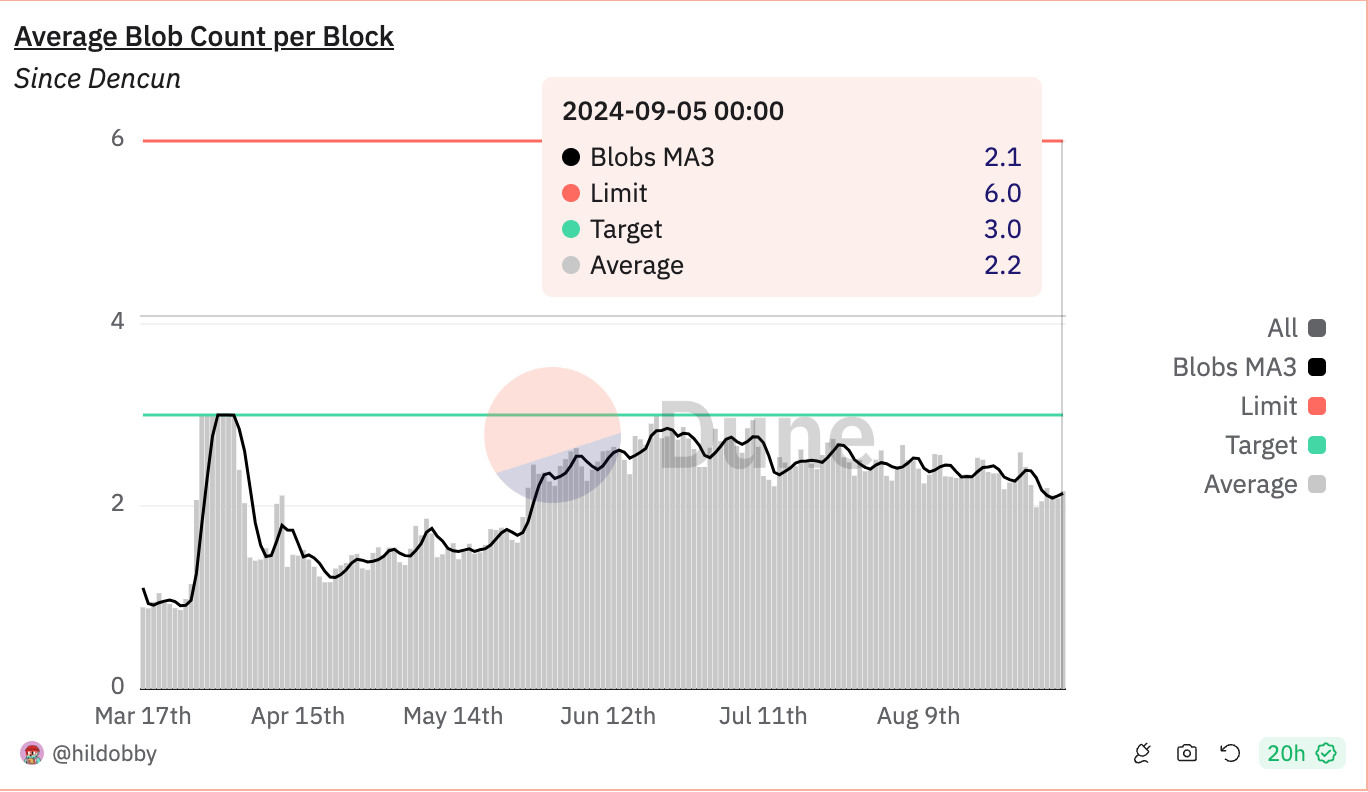

From an Ethereum ecosystem perspective, Ethereum has settled 11.91x more transactions over the past year, while fees for transactions on both Ethereum and its L2s continue to decrease. Currently, an average of 2.2 blobs are posted per block, and it’s only a matter of time before this exceeds the 3-blob target, which will drive blob fees higher. When that happens, L2s may switch to posting data as calldata if it becomes cheaper than blobs, potentially pushing Ethereum gas prices back up.

Transactions Increasingly Submitted via Private Channels

You might wonder why transactions sent via private channels impact gas prices. After all, don’t they consume the same amount of gas and contribute to block space demand? To answer this, let’s quickly refresh our understanding of Ethereum’s gas price mechanism and what private transactions entail.

Ethereum’s gas price is currently set by EIP-1559. The gas price for the next block is determined by the total gas used in the current block. If the block is 50% full, gas prices remain unchanged for the next block. If it’s less than 50% full, gas prices can drop by up to 12.5%, and if it’s more than 50% full, gas prices will increase.

Today, transactions in the public mempool that are valuable to MEV (Maximally Extractable Value) bots—through methods like frontrunning, backrunning, or sandwiching—are usually targeted. To avoid this, Ethereum users are increasingly using private channels to shield their transactions from MEV bots.

There are several MEV protection solutions available, including MEV Blocker and Flashbots Protect. DeFi swaps through platforms like CoW Swap and MetaMask also come with built-in MEV protection. These protected transactions are sent directly to block builders via private channels (like an RPC), preventing them from being targeted by MEV bots.

Now that we’ve covered the basics, let’s examine a recent finding by Blocknative, which shows that the rise in private transactions has led to volatility in base fees. Vanilla builders, who only process public mempool transactions, struggle to fill blocks since more transactions are being submitted privately.

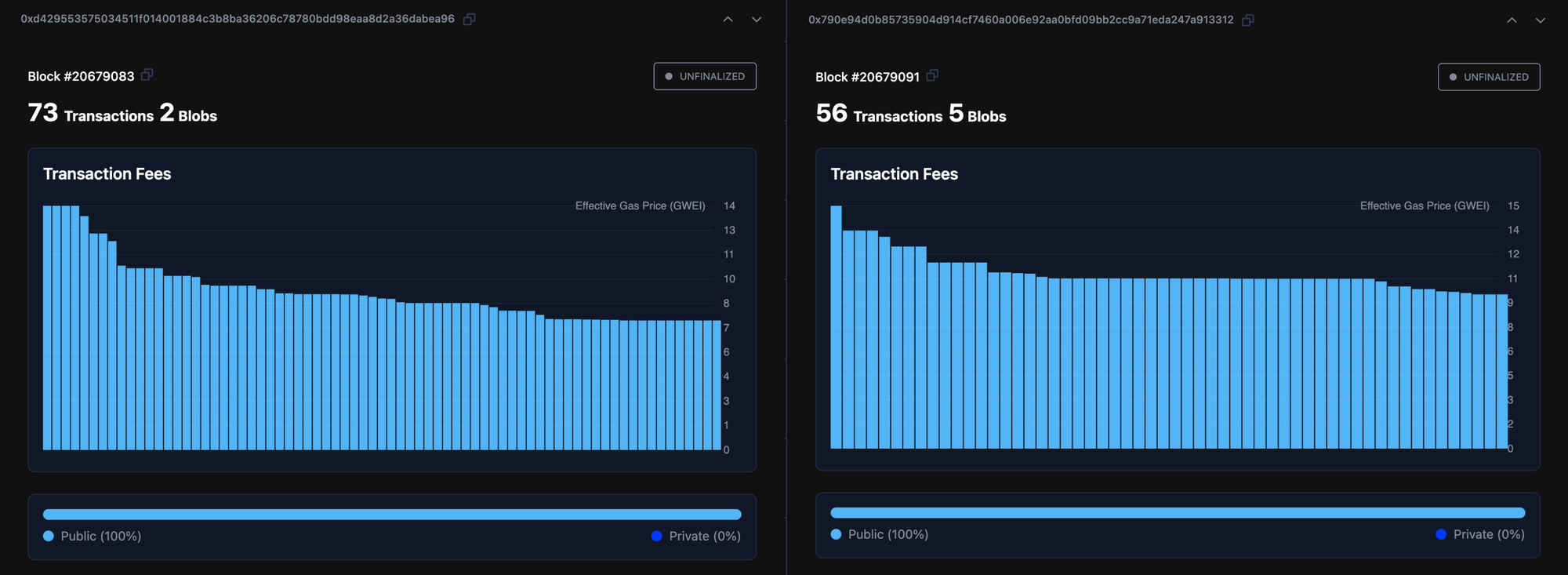

The screenshot below is a list of blocks and their respective block builders. The 2 "Fee Recipients" highlighted are vanilla builders, that only packs public transactions into their blocks. As a result, their blocks are only 15% full, leading to a drop in gas prices in the next block. Private transactions, which had to wait to be included in the next block, fill the following block completely, causing a spike in gas prices. Vanilla builders account for about 10% of all builders on Ethereum, so this phenomenon occurs roughly 10% of the time.

Vanilla builders, who only handle public transactions, typically include fewer, lower-gas transactions in each block. This is because more complex DeFi transactions are sent privately to MEV builders for protection. For example, in block 20679091, most transactions were simple transfers and approvals, which use minimal gas.

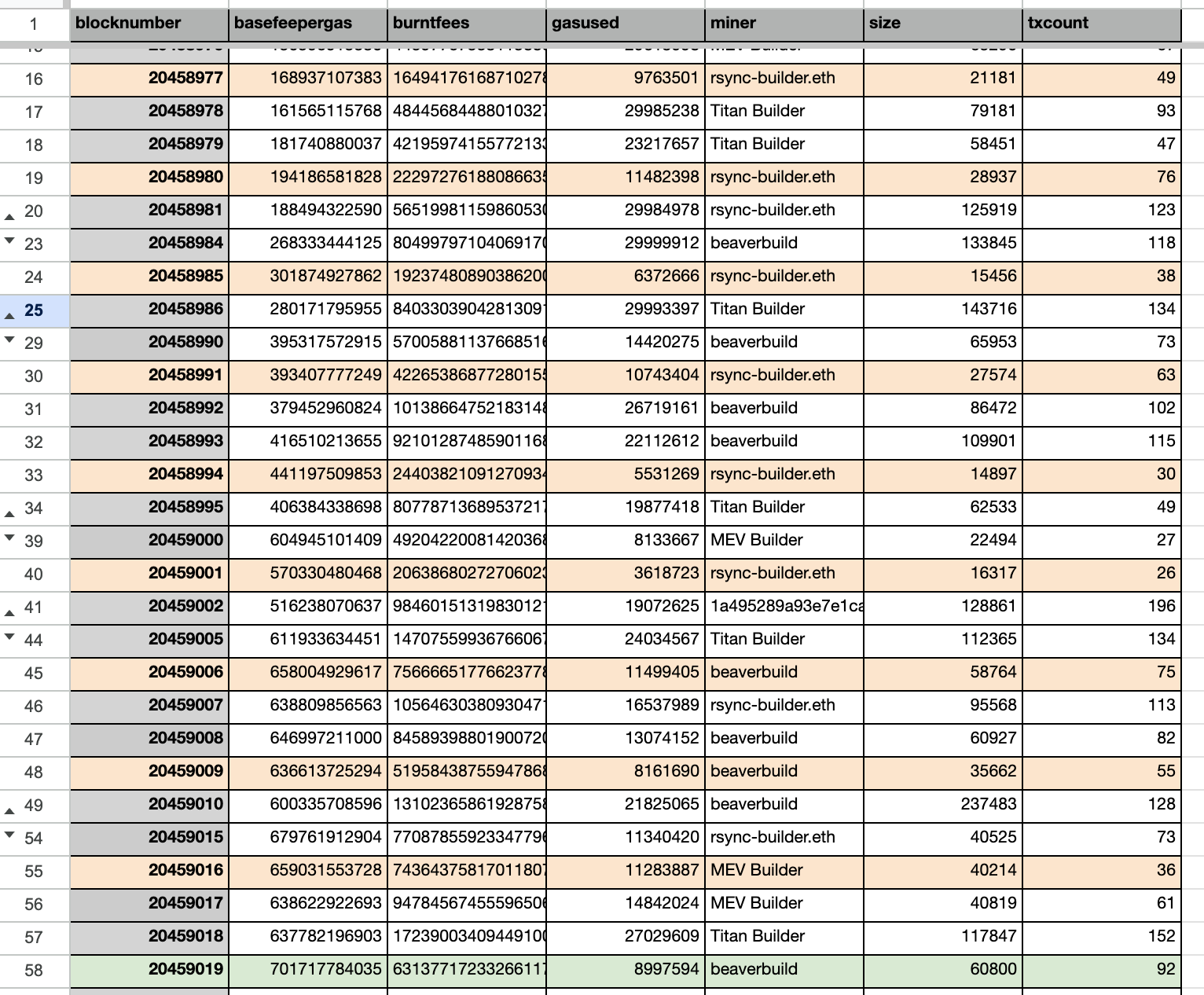

Apart from vanilla builders, MEV builders with less access to private transactions also contribute to this phenomenon. Let's look at a recent gas price hike during August 5th, 2024, where the peak base fee reaches 701.7 gwei at block 20459019.

Notice all the dips in gas price along the upwards graph. Most of them are attributable to rsync-builder.eth, an MEV builder, that included significantly fewer transactions and lower gas usage in its blocks. You can check the highlighted blocks below that are built by rsync-builder.eth on Ethernow, most of them consists 100% private transactions.

Private transactions tend to flow to builders who can ensure their inclusion with greater certainty. As builders attract more private transactions, they increase their chances of winning the MEV-Boost auction, further ensuring transaction inclusion on Ethereum.

This leads to a scenario where gas price hikes during high-demand periods are dampened by intermittent dips, while in low-demand periods, gas price drops are accelerated by low block utilization from vanilla and MEV builders with limited access to private transactions.

We can compare this to a period when private transactions represented only 5% of all Ethereum transactions. The graph below is from 11th January, 2023, showing a steep price hike, without any interference in its upward momentum.

Conclusion

The Dencun upgrade has significantly reduced consistent block space demand by creating a separate blob fee market for L2s to commit data. While some might speculate that Ethereum gas prices could rise when blob counts exceed the 3-blob target, innovations are making data availability fees cheap enough that posting to calldata will likely remain a last resort. Additionally, the PeerDAS improvement, expected in the upcoming Pectra upgrade, will further scale blob space.

With lower consistent demand from L2s and the rise of private transactions causing base fee volatility, Ethereum gas prices are expected to stay low if current conditions persist. However, this doesn’t mean Ethereum isn’t being used. In fact, daily gas usage has been trending upward throughout 2024, reaching an all-time high of 109,140.10M in gas usage on September 1st so far.

As fees remain low and block space across the Ethereum ecosystem continues to expand, it's only a matter of time before novel applications emerge to fill up that space again. Until then, enjoy using Ethereum while gas prices are low—and don’t forget to invite your friends!