This article is also published on Medium.

An analysis of trends in bridging from L1 to L2 after the March, 2024 upgrade that included blobs and more

While Ethereum is well on its way to the “Pectra” upgrade, it just had a major upgrade this past March. Called “Dencun,” this successful upgrade included EIP-4844 and other Ethereum Improvement Proposals (EIPs). Dencun introduced blobs — a temporary data store on consensus that made it much cheaper for second layers (L2s) to secure their ledger alongside the Ethereum main chain (L1). This lowered fees for everyone.

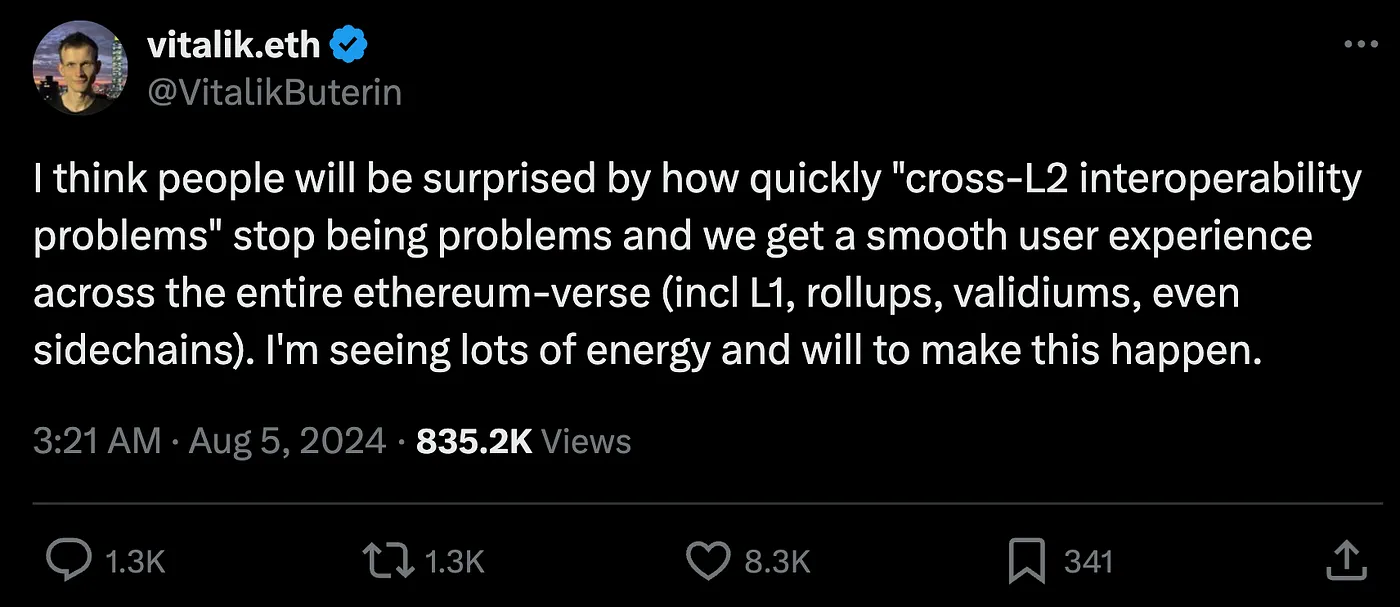

Ethereum’s road map includes many of these techniques to help scale the “ethereum-verse,” as Vitalik Buterin playfully dubbed it in a recent post. Ever since Dencun, there’s been significant excitement about the evolving L2 landscape. There are many relevant topics surrounding L2s: compression upgrades, block sizes, unifying experience in rollups and cross-chain operability and so on:

The goal of this post is simpler. To firm up our understanding of how to advance scaling in L2s, it’s valuable to analyze who is bridging from the L1 in the first place. Let’s consider 5 major L2 ecosystems to investigate how bridging activity may have changed after Dencun.

Sampling Transactions into 5 L2s

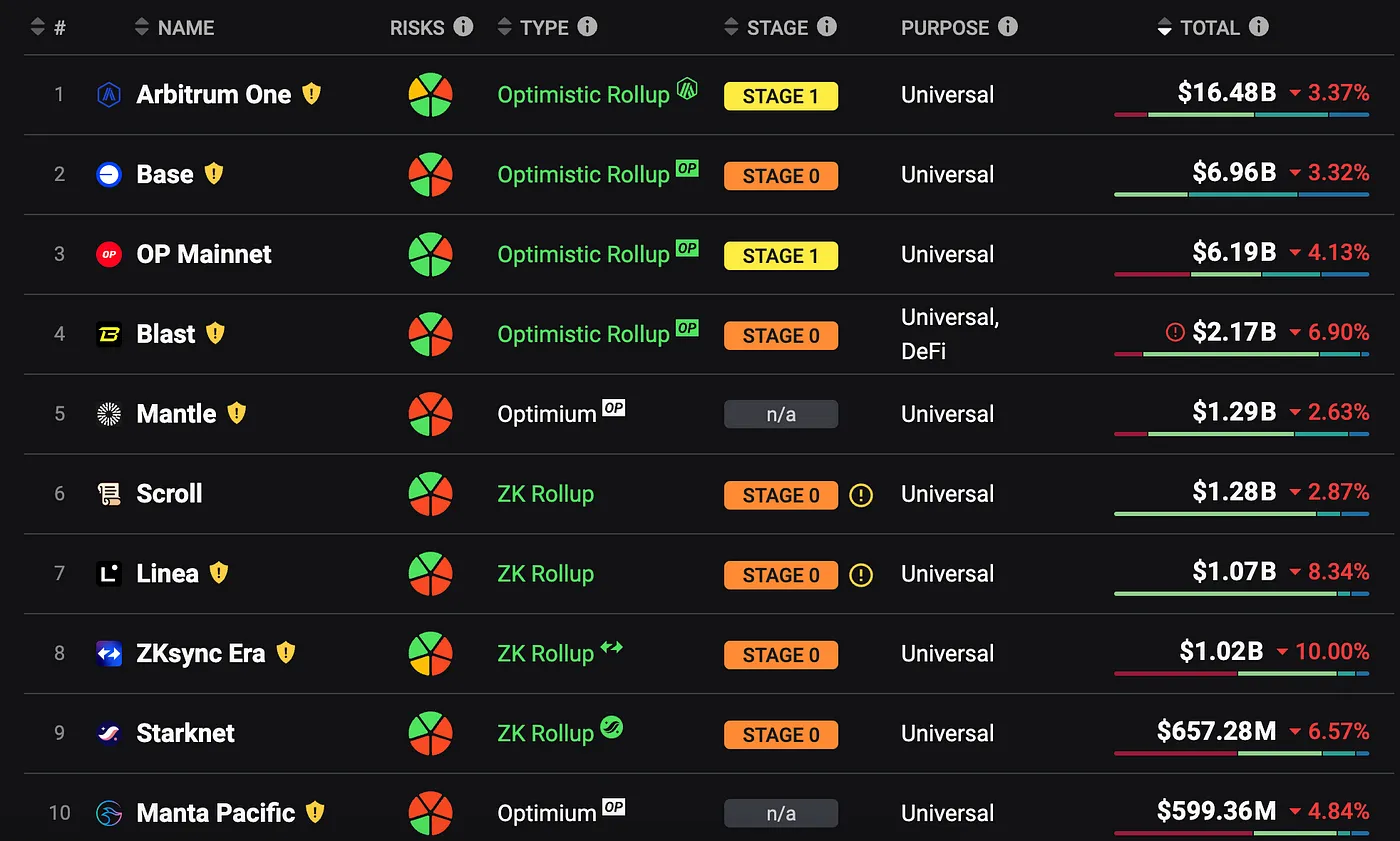

At the time of this writing, the L2 ecosystems with the most total value locked (TVL) are, in order, Arbitrum, Base, Optimism, Blast, and Mantle. We chose these 5 in this initial analysis to keep data sampling tractable. Bridges for these projects can be found with Etherscan’s comprehensive label directory along with L2BEAT’s excellent contract annotation.

With these bridge addresses in hand, we can sample regular (ETH) L2 deposits to these contracts from January 2024 to August 2024. Dencun deployed March 13th, 2024 and so the transactions around this date will reveal Dencun’s impact. Our Etherscan data sample of deposits to these 5 L2s includes almost a million total transactions to consider (871,615 to be exact).

A network diagram from a subset of these transactions is shown above as the featured image of this post. It shows the hundreds of thousands of wallets engaging the five chains with lines between them the bridges.

Rise in Transaction Count

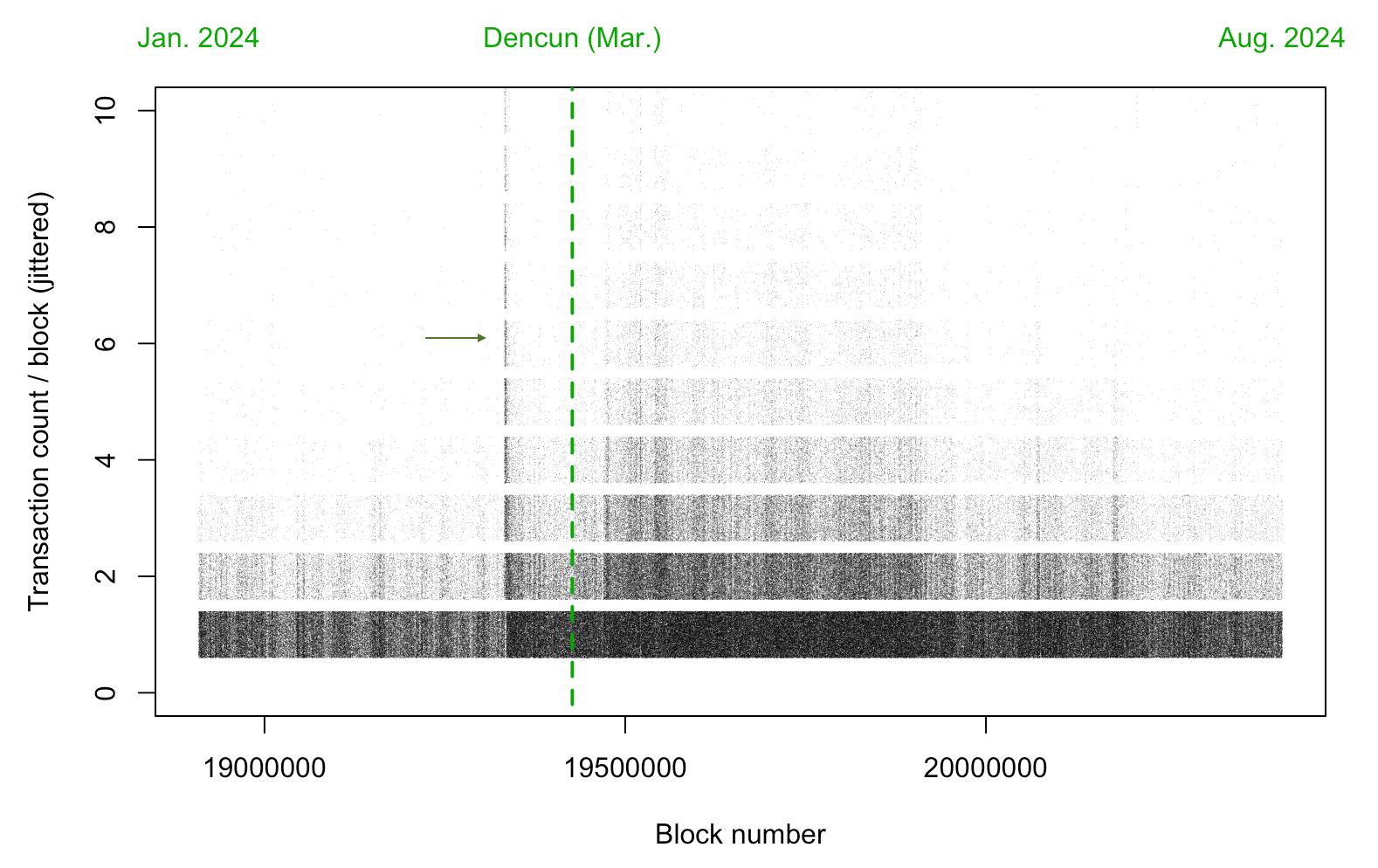

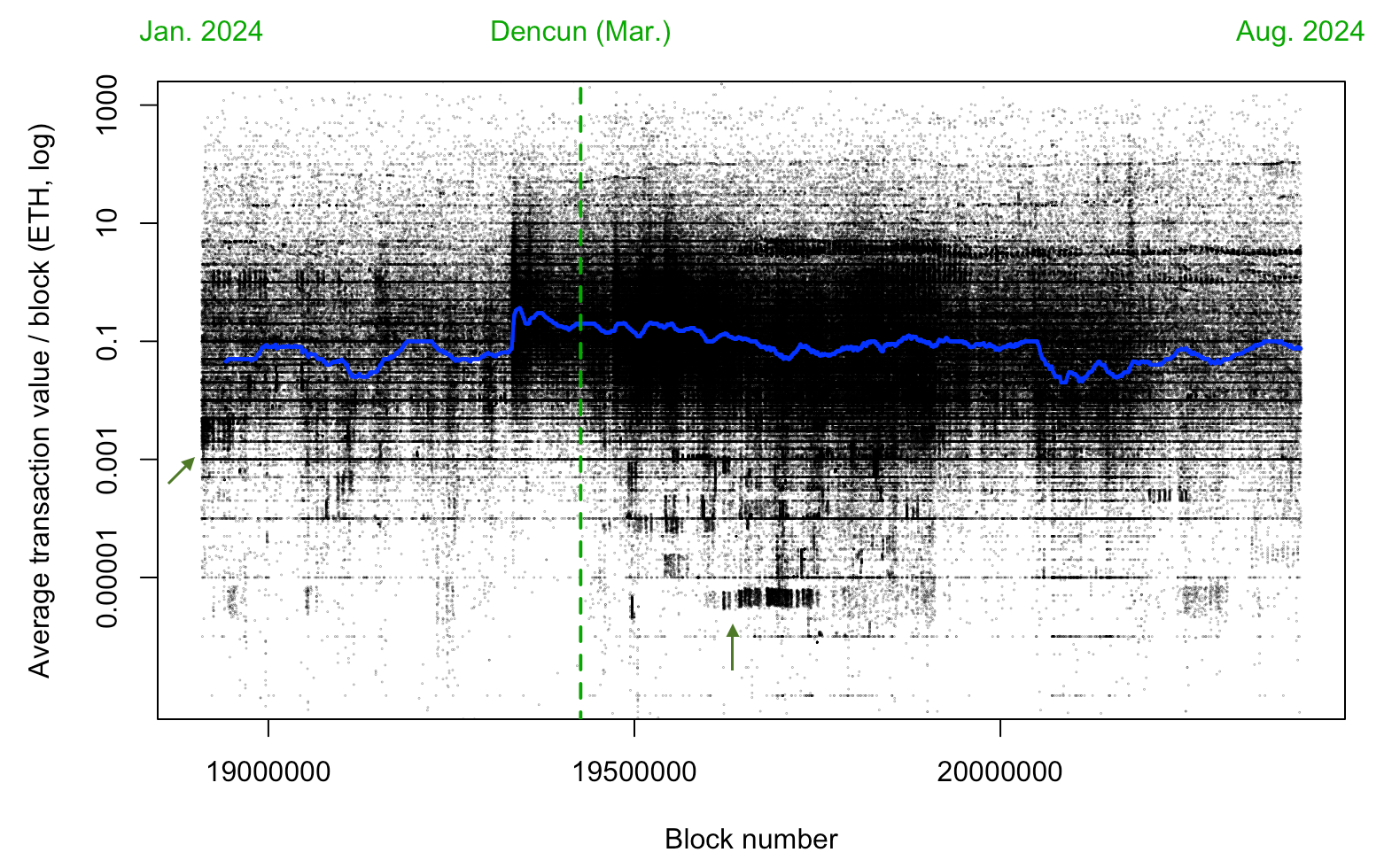

It was widely discussed that Dencun led to an increase in L2 usage. We can see this below in a plot of L2 bridge transaction per block across this time range. We see transactions rose rapidly near the end of March, right after Dencun was deployed. Curiously, there was a burst of activity in a cluster of blocks prior to the Dencun upgrade (shown with the arrow below). This was an orderly rise right before the upgrade, and was associated with Blast’s L1 standard bridge. Probably timed to go live before Dencun, Blast’s Feb. 29th release led to a large wave of bridge transactions, over 2 billion USD TVL.

After the Dencun upgrade, there is another and sustained wave of usage as transactions per block rise and fluctuate. This fluctuation may have been due in part to the timing of adoption of blobs by L2s, which varied (L2BEAT shows this date for each ecosystem).

Though transaction per block has receded since the post-Dencun bump, this metric is still considerably higher than before Dencun. Excluding the Blast spike, there was 1 bridging transaction per 25 blocks in January and February. By this past July and August, there’s been, on average, a bridge transaction about every 2 blocks in just these 5 L2s.

Some Trends in Bridging Value

An interesting trend appears when plotting average transaction value. Below is a plot of those approximately 1 million transactions by block height and transaction value in ETH. Each dot is a transaction. The value of transactions rises slightly, but perceptibly, around Dencun (1-day moving median shown in blue). In this data sample, the median bridge amount was about 0.05 ETH early in the year, and rises over 100% to about 0.12 ETH before and after Dencun. Median deposit value has dropped back in recent weeks. It was widely reported that Dencun led to a massive drop in fees (see our prior post). This rise may be associated with more users who were ready to try L2 in a more hospitable fee environment.

In the plot above, we also see lots of clustering around particular ETH values. An example is shown with arrow in the graph, just after Dencun. When zooming into this cluster of transactions, we find these are almost entirely associated with over 1,000 tiny transactions just to Base’s portal. When seeing such clustering, we can ask questions about their purpose: Test transactions? User incentives? Sybil (fake user) attack? Without further investigation, we can’t be sure — but in that cluster, many of these wallets are associated with a single funder.

There are also thousands of bridges at about 0.001 ETH in value across this entire time range (see the little arrow in the left margin). A major issue that has arisen in various L2 deployments and upgrades is the risk of gaming airdrops or other incentives. For example, zkSync had an airdrop this past June, and tackled complications around distribution and Sybil. (Though not included in the analysis here, zkSync is in the top 10 by TVL shown above.)

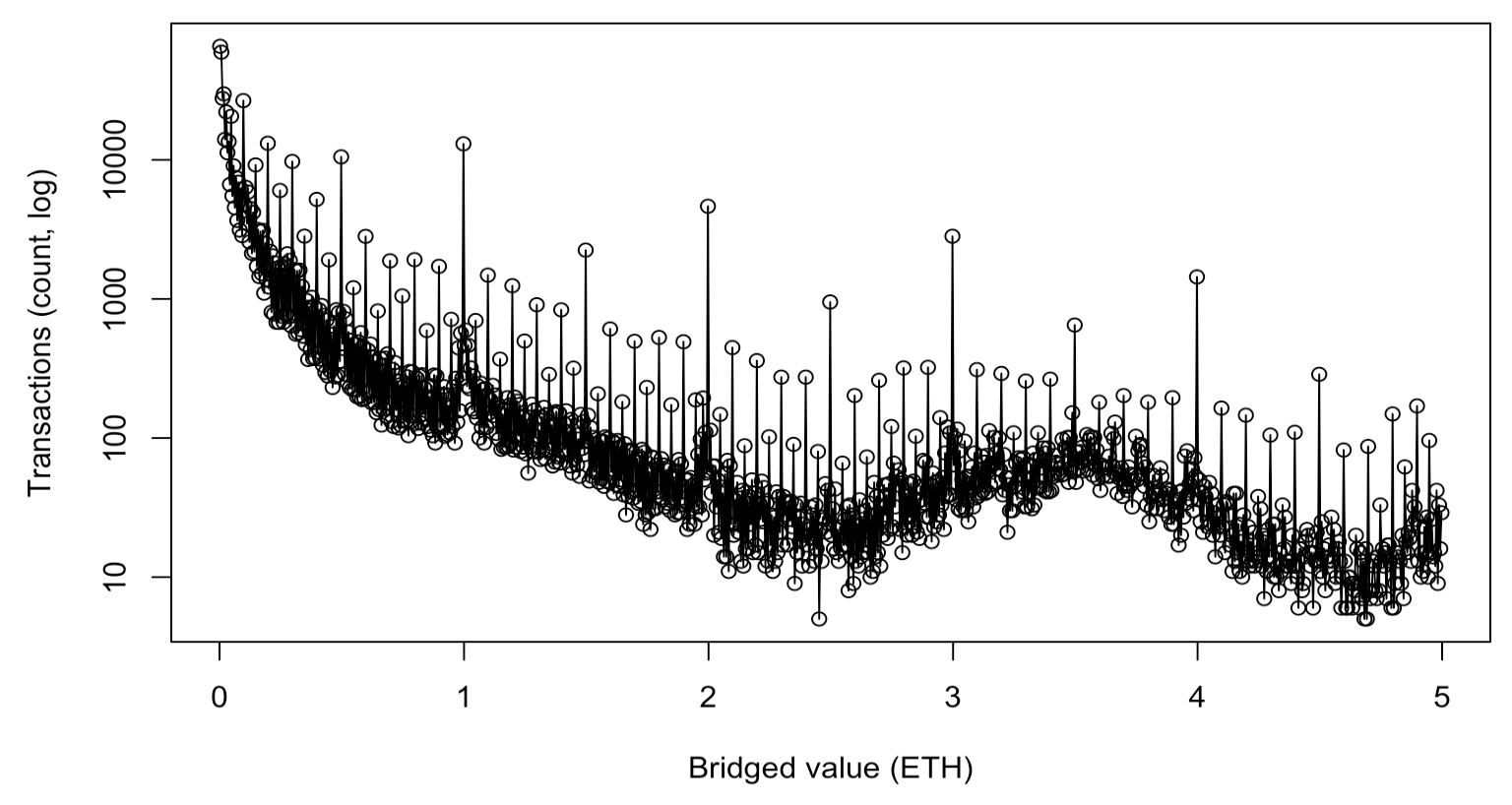

Interestingly, this trend for particular values may just be a natural inclination of human users to send factors of 10. Looking at the distribution of bridging value from 0.001 to 5 ETH, we can see “spikes” at regular powers of 10.

Trends in Unique Addresses

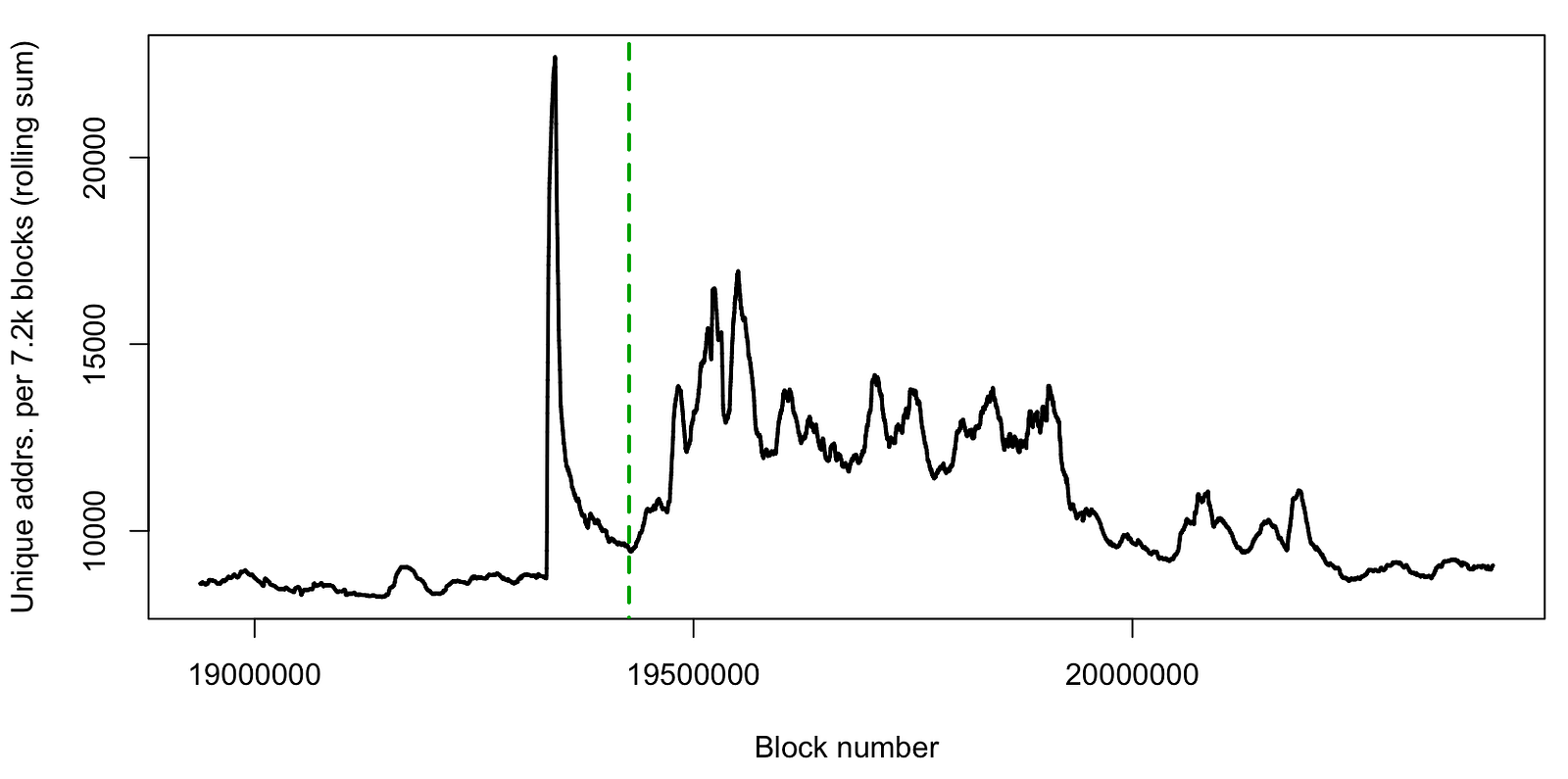

If it’s true more users felt eager to jump into L2s after Dencun, we should see a rise of unique addresses across this Dencun boundary. Plotting a sliding window of approximately 1 day’s worth of blocks, we see a substantial rise in unique addresses engaging in transactions with these L2 bridges.

We can also focus our analysis on individual users of L2s. To do this, let’s take our approximately 1 million transactions and tabulate the number of transactions each unique address makes on each L2.

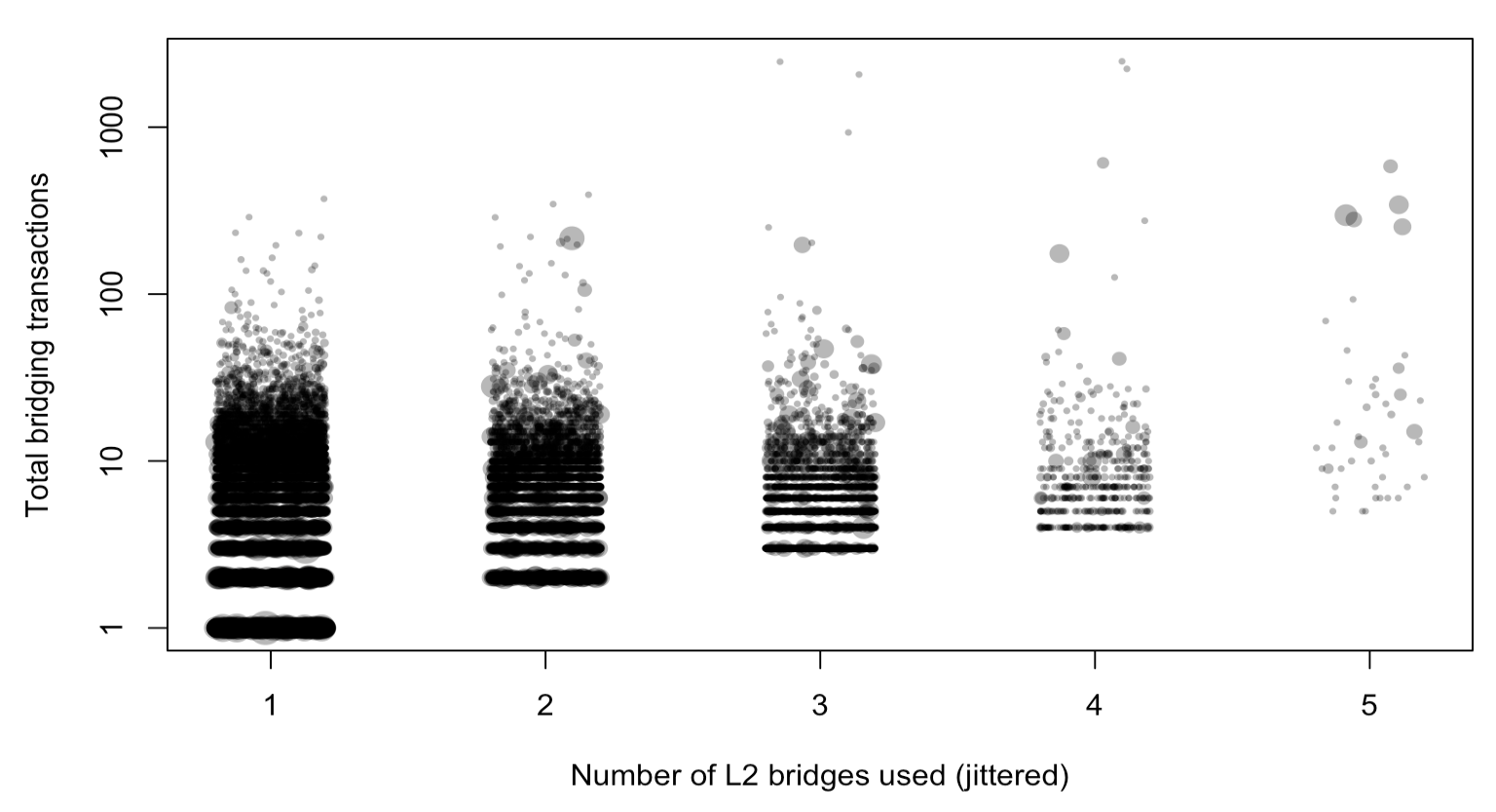

Perhaps surprisingly: 93% of the approximately 500,000 addresses in this data sample engaged a single L2 ecosystem by bridging. Out of the remaining 7%, most used two L2s. About 1% of addresses deposit to 3 or more. Only 46 addresses interacted with all 5 projects. In general, the usage of an address is associated with the number of L2 ecosystems they use, though this relationship is not perfect (r is about 0.4, p < .0001, for those who like correlations; see plot below).

Generally the more L2s an addresses uses, the higher the average bridging value. When an address used just one L2, its median bridged value is 0.03 ETH. When an address used 5 L2s, its median is 20 ETH. When looking at some of the 46 wallets that use all 5 ecosystems under study, some seem to be “whales” consolidating major L2 DeFi activity.

This extent of L2 use did not change much across Dencun. In other words, before and after Dencun, the vast majority of addresses use a single L2 (of the 5 we examine here). On average, wallets did have about a 1% increase in the number of L2s they deposit to after Dencun. This is statistically significant (p < .0001 under t-test) but likely too small to be meaningful.

Conclusion & Future

We often think in terms of homogenous metrics of activity: Numbers go up and go down indicating flocking towards (or away) from ecosystems. Dencun definitely led to a large wave of transactions and unique addresses engaging L2s. But zooming into transactions reveals more structure. Median transaction rose suggesting willingness to bridge more unit value as users came in droves. Clusters of transactions may indicate that L2-specific farming or other activities are taking place. There is major disparity in how many L2s an address uses: Most bridge to a single L2, maybe selecting a favorite and trying it out. A smaller subset bridge to many L2s, and these seem to be, at least in part, “whales” that we’d expect from such engagement.

The finer-grained details matter, and the L2 ecosystem, while amplified generally by Dencun, contains varied signatures of distinct usage. Future analysis will delve into specific activities on the L2, and which of these transactions are bridging ERC-20 tokens (about 19% of these transactions have ETH value of 0, likely contract interactions and token transfers, which we did not analyze here).

Still, these simple initial results suggest a few things about L2 adoption:

- Unifying experience through a popular rollup may help expand engagement. Network effects on the L2s, where most are bridging (at the moment this is Arbitrum), may be critical as the data suggest most bridge to only one L2. This approach would have the downside of weighting one chain’s user experience, but it may help diversify engagement generally once into the L2. If the experience were unified in a way that is guided by this network effect, it would remain decentralized architecturally.

- “Vampire attacks,” distressing and exciting all at the same time, may be important for advancing bridging techniques on existing or new L2 ecosystems. If users tend to bridge from L1 to just one L2, then new projects may wish to focus on an experience that overlaps with the most relevant competing chain’s experience (in other words, consistent with point 1 above, trying not to do everything for everybody).

- Users may not be inclined to engage so many ecosystems. Because of this, as Vitalik noted at the start of this post, cross-chain operability such as through Relay Protocol will be critical. If it’s easy and low cost to jump across L2s, then we need only one L1 bridging transaction.

These are important usability questions that we may think of as separate from the main reasons we engage L2s and why they compete, such as settling time. But our initial results above suggest that adapting to user experience may be a critical variable here. If we want L2s to be a functionally diverse space achieving a mixture of purposes and experimenting on new experiences, then it may help simply to get users into the broader L2 ecosystem and cheap, fast cross-chain L2 bridges may help new projects to gain traction.

—

I’m on Twitter and create things. I wrote this for fun and was not paid, and I welcome all feedback, ideas, corrections, etc. Caveat, disclosure: I sometimes own the things I mention but try not to overdo it.