It seems like every week brings news of a new Layer 2 (L2) launching or announcing plans. Uniswap has introduced Unichain, World (formerly Worldcoin) has launched World Chain, and Kraken has announced plans for an L2 in 2025. The L2 space is expanding rapidly, and we’re either entering or already in the golden era of the rollup-centric roadmap.

Each L2 takes a unique approach to scaling Ethereum. Some are general-purpose, others focus on high throughput and low latency, while many are application-specific, targeting areas like DeFi, social platforms, gaming, or consumer use cases. The reasons for creating new L2s are numerous, and as the ecosystem evolves, we’re still discovering more.

95% of the ocean is still unexplored which means there could be another L2 down there

— Ivory (@holaivory) October 25, 2024

An L2 scales Ethereum by executing transactions off-chain, then posting compressed transaction data back to Ethereum. Ethereum’s role is to validate that these L2 transactions were correctly executed. But with so many L2s launching, the question arises: Are all of them posting their compressed data back to Ethereum?

In this article, we'll explore the basics of data availability (DA), the evolving DA landscape, and the different approaches L2s are taking regarding DA.

What is Data Availability Anyways?

"Data availability" can be confusing, so here’s a simple analogy before diving into the details:

Imagine L2s as banks that handle quick, daily transactions. To secure these transaction records, the banks send them to a highly secure vault (Ethereum) at regular intervals. Security guards verify these records when they arrive at the vault.

As a customer, you can rest easy knowing that your money is safe. Even if the bank has issues, you can access your transaction records directly from the vault to recover your funds. The vault ensures these records are protected from tampering.

In simple terms, DA means that L2 data is accessible to all validating nodes during block verification. This ensures that, in case of an emergency, an L2 user can withdraw funds directly on Ethereum since the L2’s state root is verifiably available on Ethereum.

Ethereum as the Data Availability Layer

Currently, there are two ways to post L2 data onto Ethereum as the DA layer:

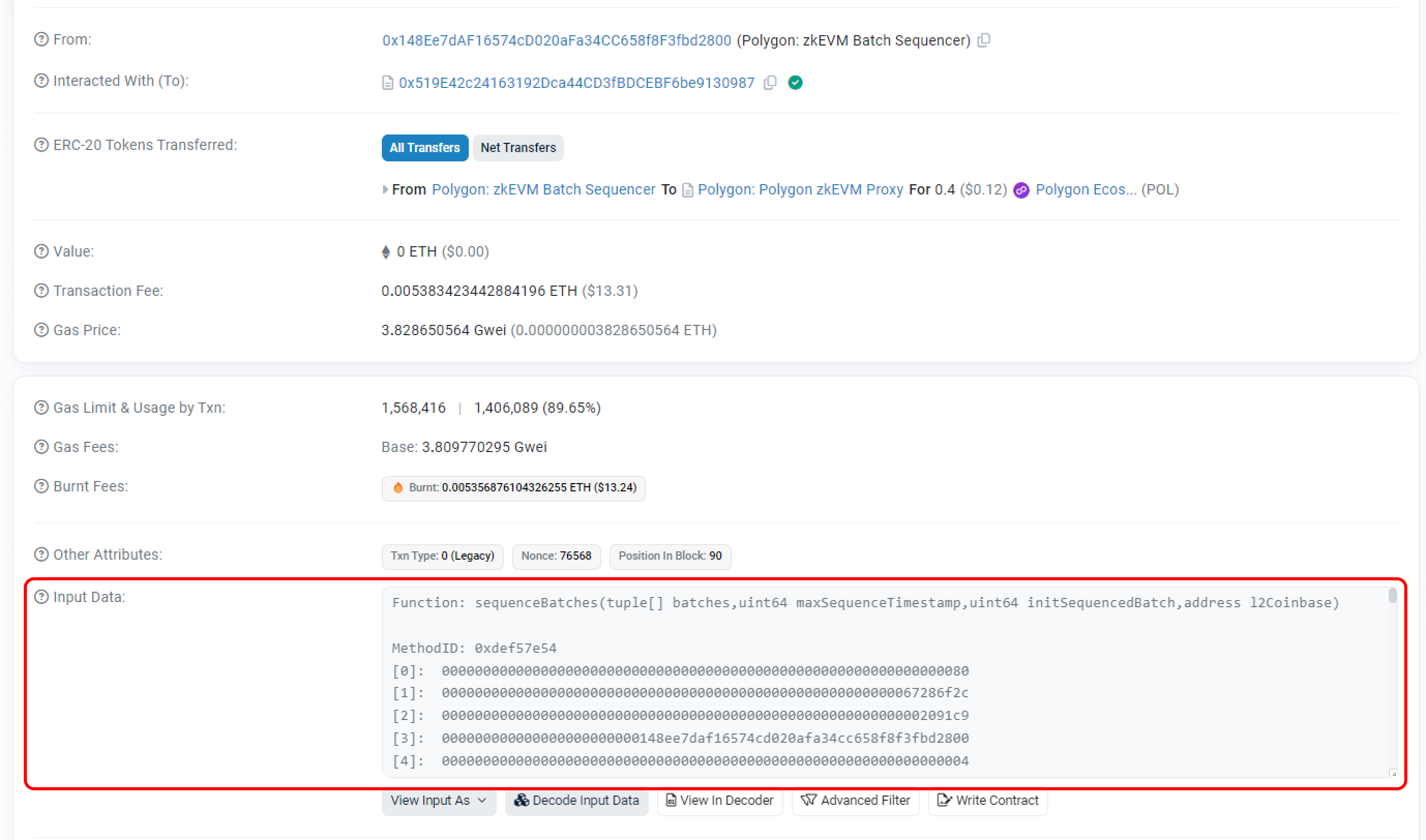

- Calldata: Used by platforms like Polygon zkEVM, which posts L2 data onto Ethereum's calldata.

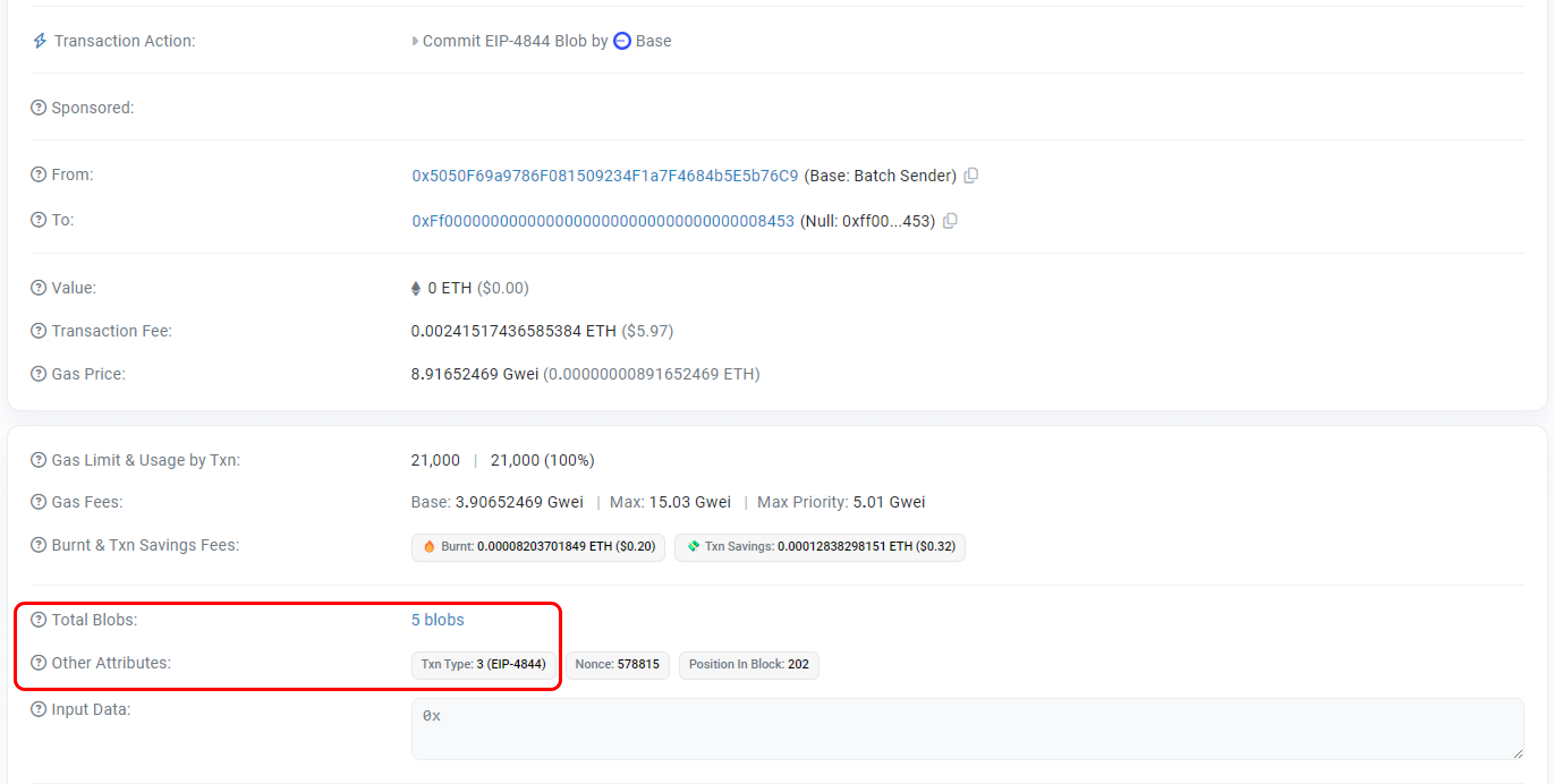

- Blobs: Introduced in the Dencun upgrade, blobs offer a new, temporary storage outlet for L2 data. Base is one L2 that posts data onto Ethereum's blobs.

In the examples above, Polygon zkEVM pays more than twice the transaction fees to post data via calldata compared to Base, which uses blobs. Calldata is expensive because it consumes Ethereum's storage space permanently and competes with other transactions in the gas market. However, blobs could become more costly if the blob fee market surpasses the regular gas fee market.

Before March 2024, many L2s posted data to Ethereum’s calldata regularly, keeping gas fees high. As more L2s go live, this could lead to even higher fees, which would be passed on to L2 users—defeating the purpose of scaling Ethereum for cheaper, faster transactions.

Did you know? 🤔

— Etherscan (@etherscan) March 22, 2024

The Dencun upgrade was activated last week on March 13th at 13:55 UTC, introducing proto-danksharding aimed at reducing fees when L2s commit data to Ethereum

Quick comparison of Ethereum data before & after Dencun 🧵

The Dencun upgrade was a first step toward improving DA for L2s. Blobs are temporary chunks of data, visible to consensus layer clients, that expire after 18 days—sufficient time for most L2s to finalize their data on Ethereum. Blob fees also operate in a separate market, reducing competition with regular Ethereum transactions.

Ethereum has been at blob target for over 2 days now

— hildobby (@hildobby_) October 31, 2024

src: https://t.co/zt1nL4kzq4 pic.twitter.com/IuNo6hvQV3

As blob usage grows, fees for posting to blobs will rise. Additionally, as more high-performing L2s launch, the current blob implementation may struggle to meet demand.

Discussions are ongoing to scale blob capacity and throughput while preserving decentralization. These include EIP-7594 (PeerDAS), EIP-7762 (increase min base fee per blob gas), EIP-7691 (blob throughput increase), and EIP-7623 (increase calldata cost to encourage more blob usage).

What are the Alternatives to Ethereum DA (AltDA)?

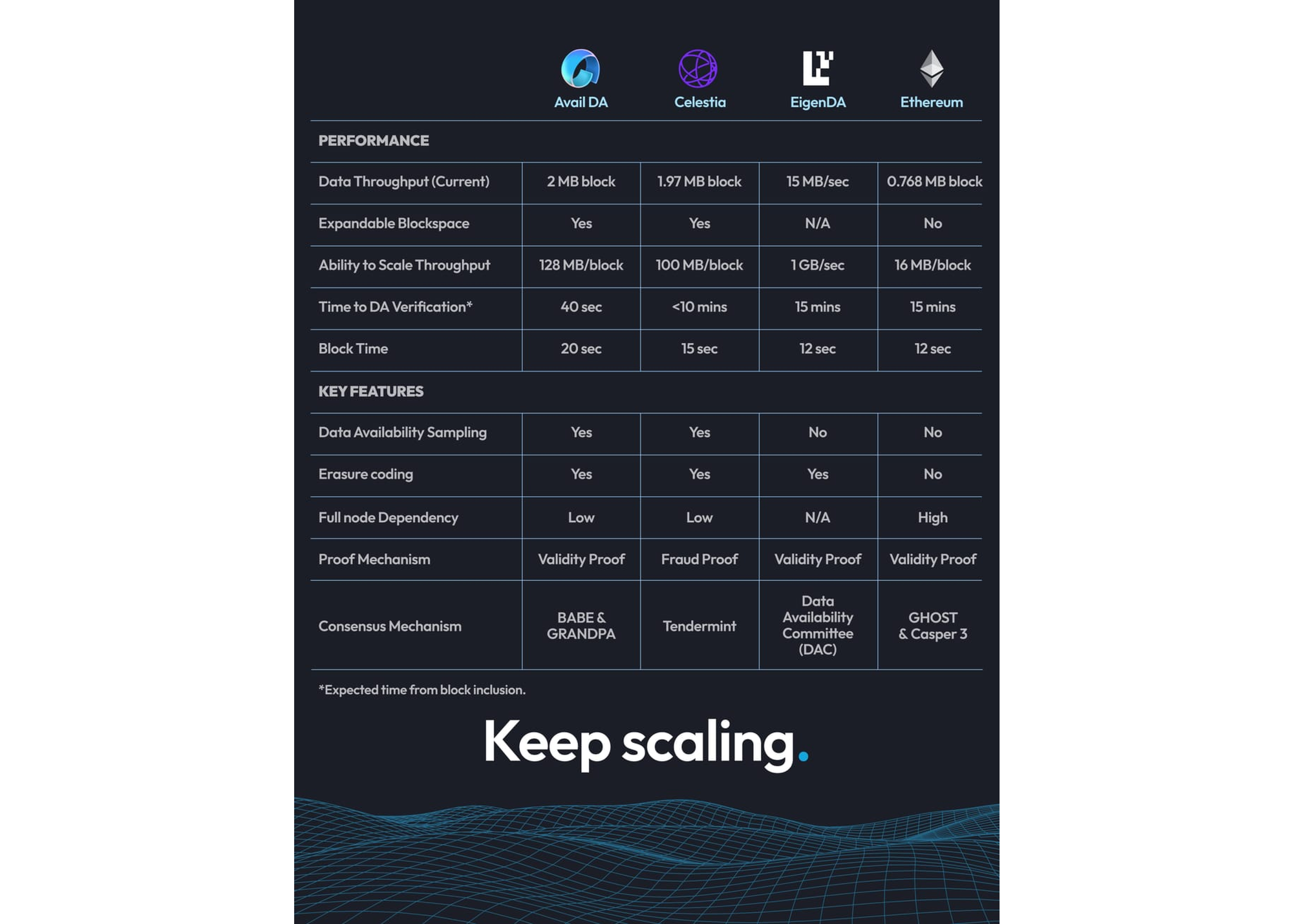

While improvements to blobs are in progress, multiple services now offer cheaper and more efficient DA options. For example, Avail compared several alternative DA (AltDA) providers to Ethereum, each with its own strengths.

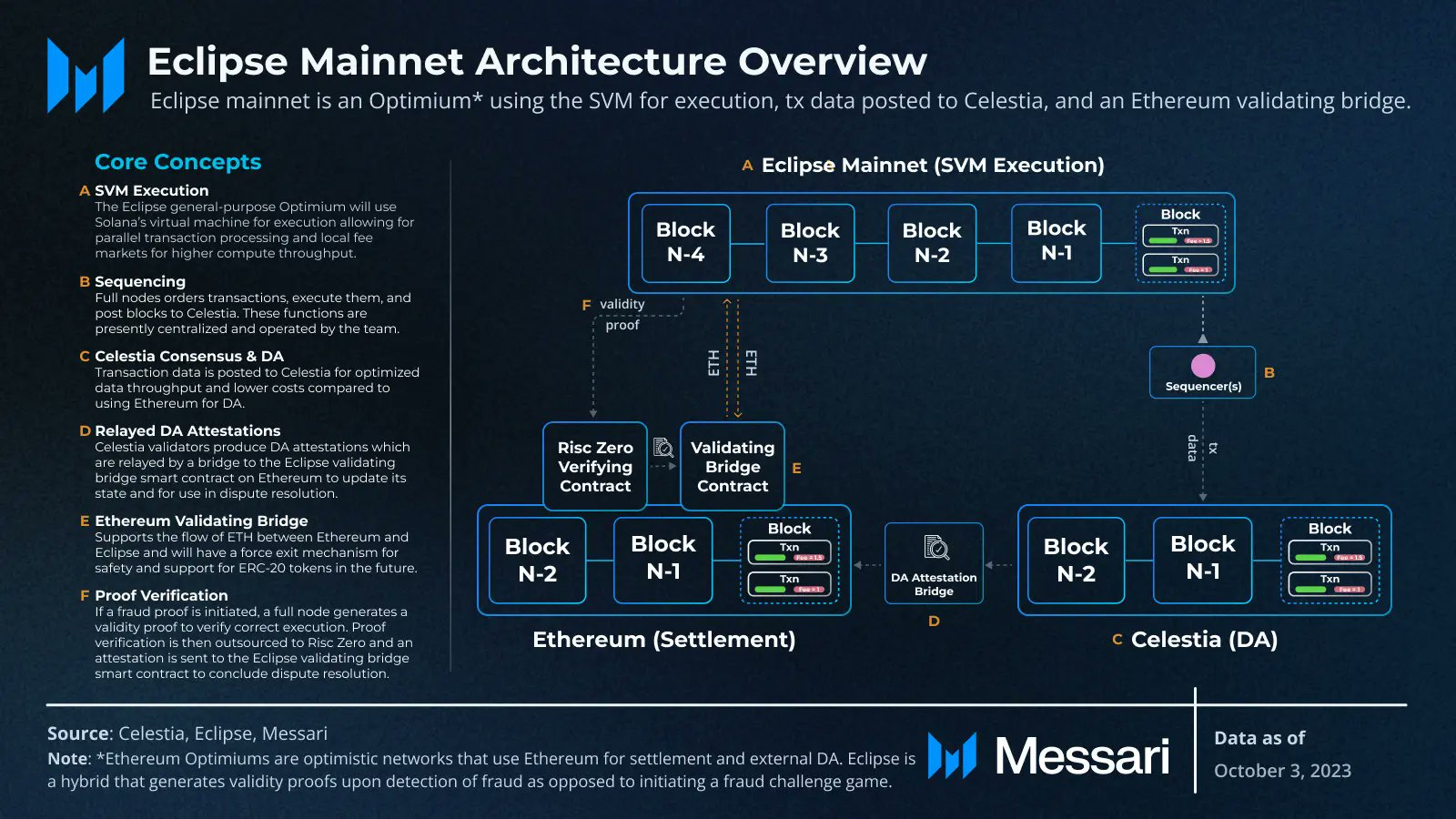

Some L2s, like Eclipse, use Celestia as their DA layer while relying on Ethereum for final settlement. Here's an architecture overview for Eclipse:

So, why would anyone use Ethereum for DA if AltDAs are cheaper and more efficient? Vitalik explained that using a separate system for DA can lead to lost (though not stolen) assets in case of a data availability failure. While AltDAs may not match Ethereum’s security, they often use strong verification methods to ensure the integrity of L2 data.

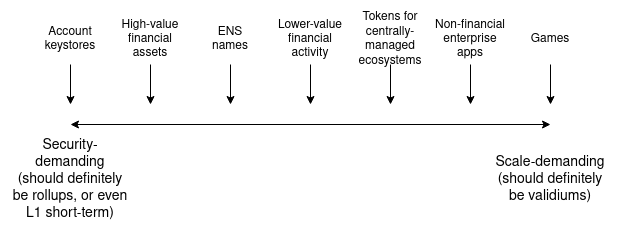

L2s using AltDA are typically called validiums (if they use validity proofs) or optimiums (if they use optimistic proofs), in contrast to validity rollups (or zk rollups) and optimistic rollups that use Ethereum for DA.

You can explore more about different Data Availability layers on L2BEAT:

The wait is over! 🙌

— L2BEAT 💗 (@l2beat) November 6, 2024

Today, we’re excited to launch DABEAT - your go-to platform to explore Data Availability layers, essential for ensuring user access to L2 transaction data.

Maintained by L2BEAT team, DABEAT helps you assess the unique risks across the growing DA landscape. pic.twitter.com/qTYwDja0Ny

Closing Thoughts

How does an L2 decide whether to use Ethereum DA or an alternative? As Vitalik noted, L2s exist on a spectrum between rollups and validiums/optimiums, with trade-offs between cost and security.

Ethereum’s position as the most secure data availability (DA) layer will continue to attract Layer 2s (L2s) that prioritize high security and decentralization. At the same time, alternative DA layers offer efficient and cost-effective solutions for specific use cases, allowing L2s to choose based on their performance, cost, and security needs.

This flexibility empowers the Ethereum ecosystem to scale more rapidly while supporting a wide range of applications, from DeFi and gaming to consumer and identity solutions.