This article is also published on Medium.

Introduction

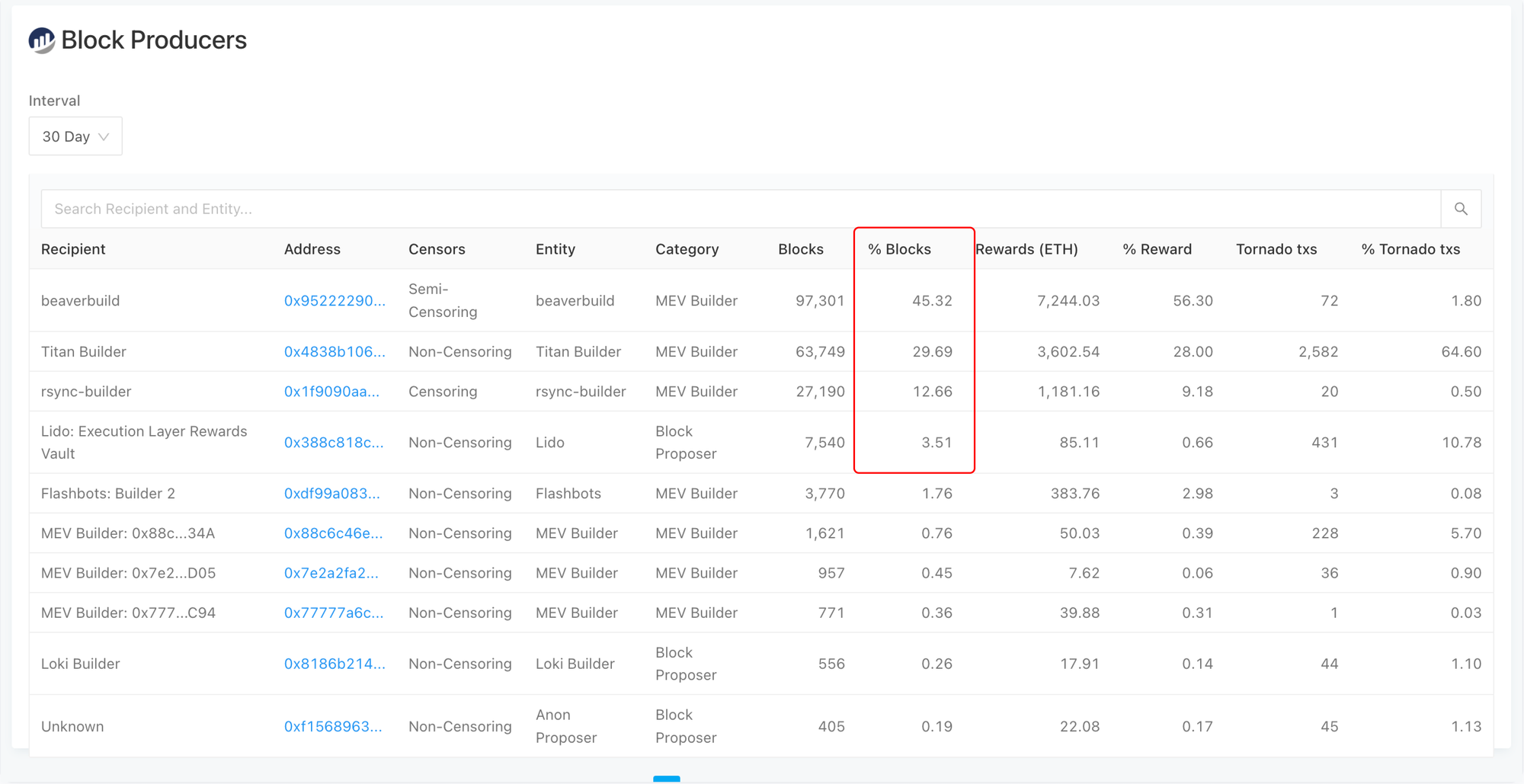

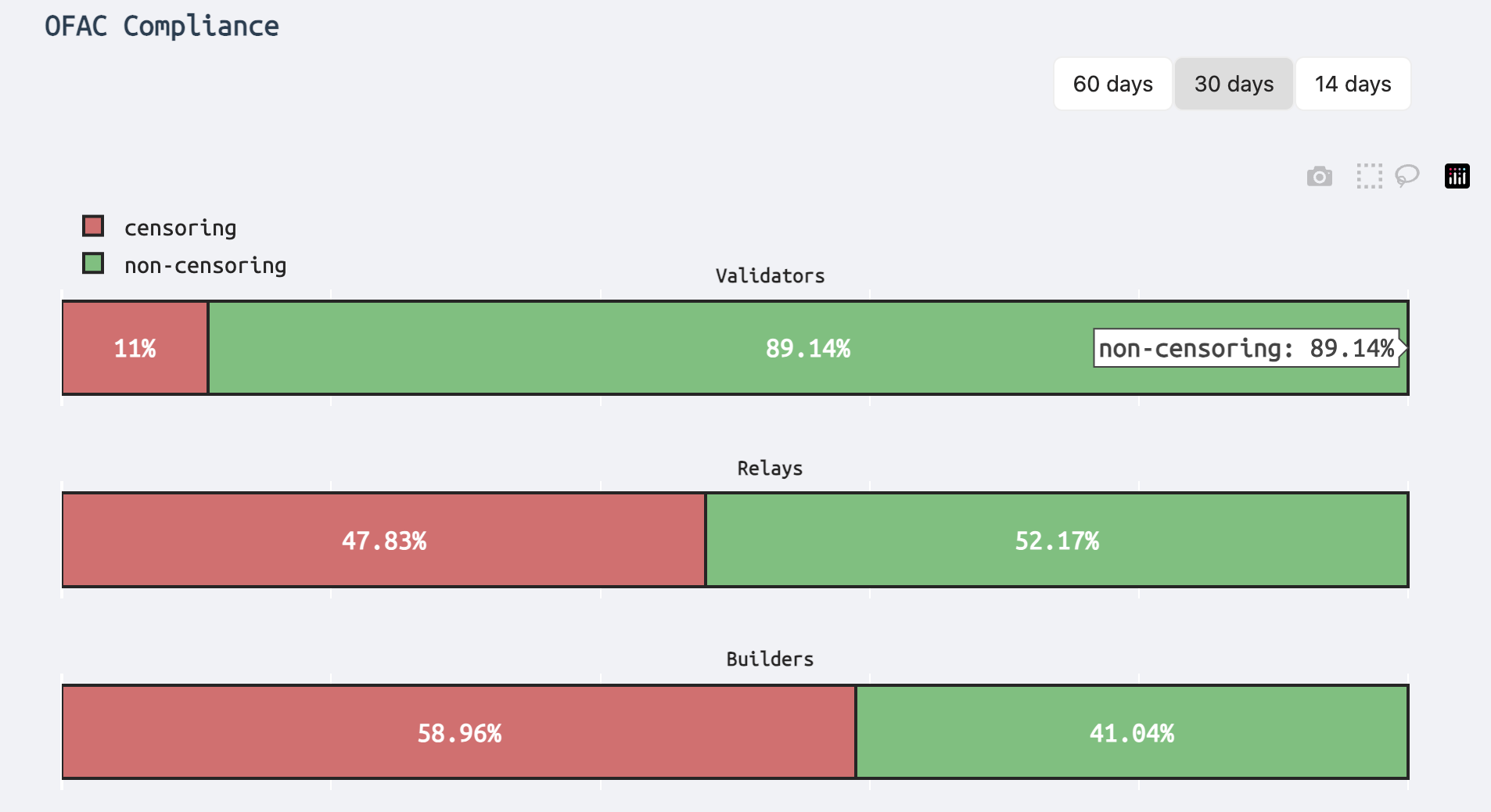

Approximately 90% of all Ethereum blocks have been built by just 4 block producers in the past 30 days. The largest builder, beaverbuild, holds a market share of nearly 50%. With both beaverbuild & rsync-builder censoring OFAC-sanctioned transactions, it means that only about 40% of blocks are censorship resistant.

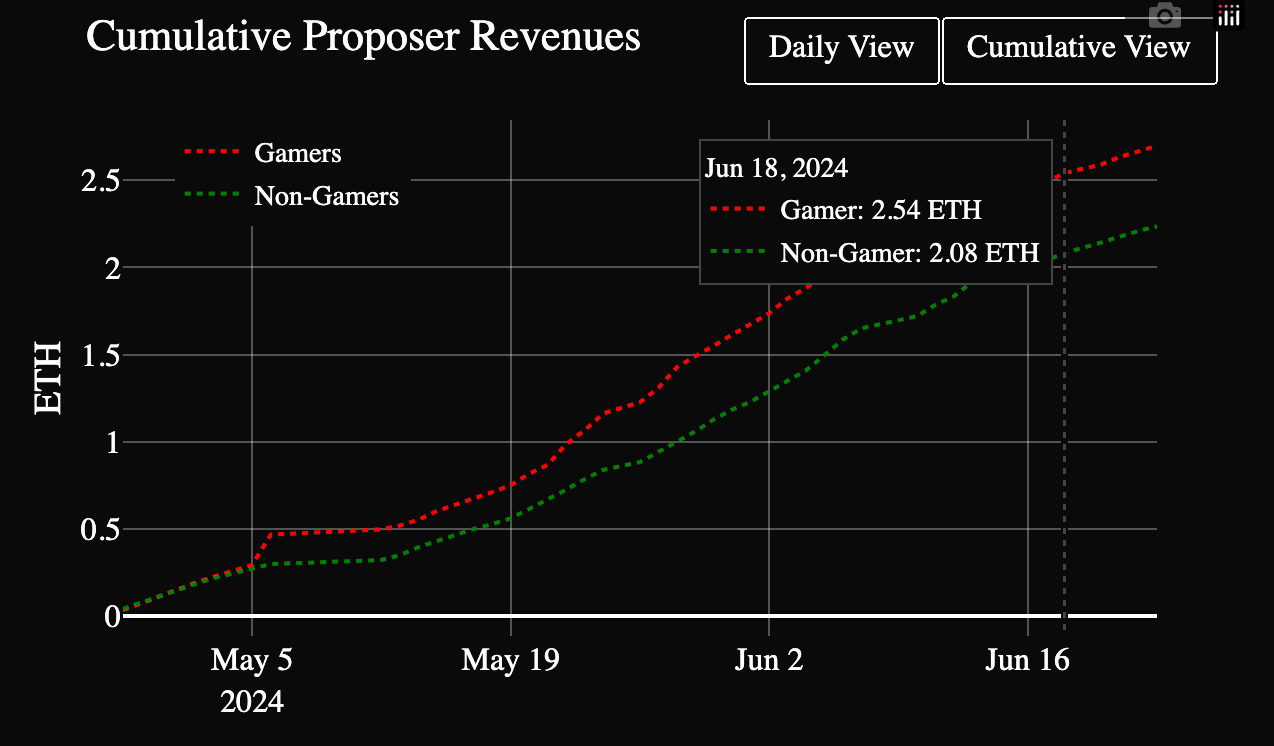

Specialized builders can order transactions within a block, constructing maximally profitable blocks that extract value from users' onchain interactions. A recent finding by EF researcher Toni Wahrstätter revealed that builders who use MEV-Boost earn a higher APY compared to those who don't.

If you’re wondering why this is happening on Ethereum and whether devs can do something about it, read on. In this article, we'll explore how we got to this situation, the implications of proposer-builder separation (PBS), and the latest research and discussions aimed at finding a solution to this problem.

How We Got Here

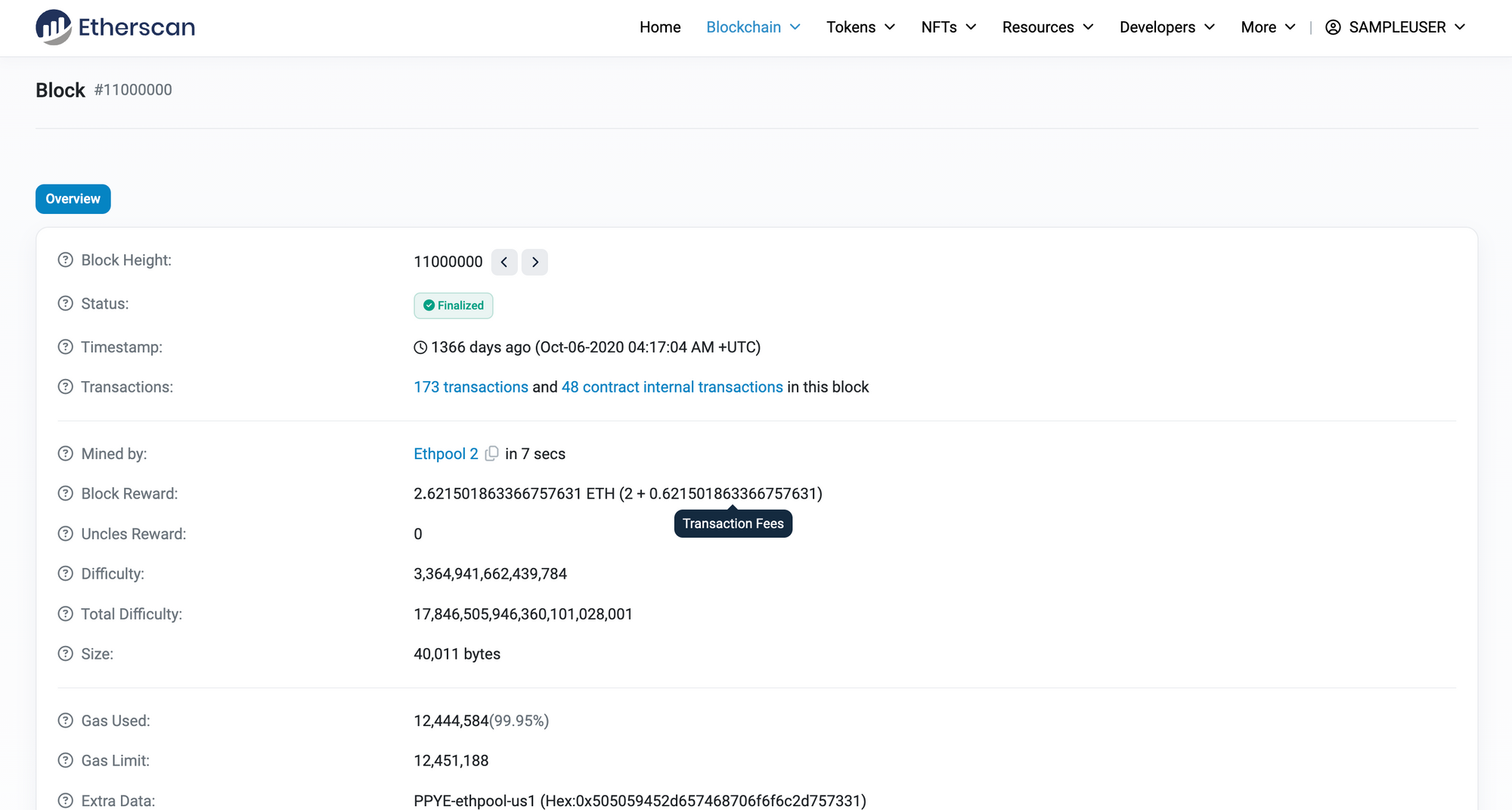

Since genesis, miners were responsible for processing Ethereum transactions. When a user signed a transaction on their wallet, it was broadcasted to the network and resided in a public mempool. Miners listened to the mempool for new transactions, aggregating them into potential blocks. They received a block subsidy for successfully appending a block to the canonical chain and collected transaction fees from users to incentivize faster inclusion.

Soon, extraction bots were created to find profitable opportunities to capture MEV by competitively bidding higher transaction fees for priority ordering, known as Priority Gas Auction (PGA). Miners could also capture MEV by reordering, including, or removing transactions to favor themselves. The term "MEV" was first coined in the research paper Flash Boys 2.0 and later recognized as a fundamental concept on Ethereum in the article Ethereum is a Dark Forest.

MEV gained traction during the DeFi Summer in 2020, when innovative developments in DeFi lending platforms and exchanges attracted many users to transact onchain.

The network's transition to the Proof-of-Stake consensus mechanism during The Merge fundamentally changed block production on Ethereum. Network participants validating and proposing blocks now require only 32 ETH instead of expensive mining equipment. This caused an influx of new validators to the network, who lacked the expertise to optimize blocks as miners once did.

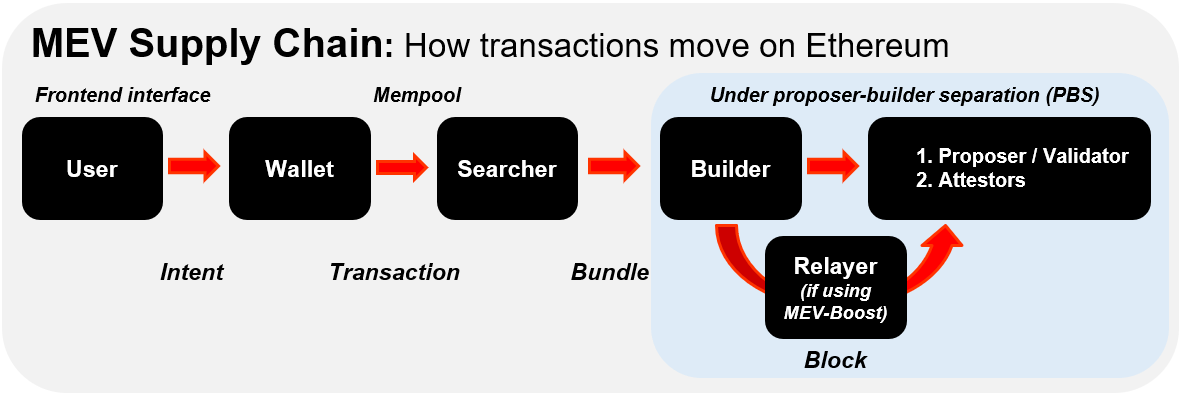

Block builders specializing in optimizing blocks emerged to construct blocks on behalf of validators. They prepare full blocks, optimize for MEV extraction via private order flow or MEV bundles sent by searchers. Using MEV-Boost, a protocol-sidecar, builders forward blocks to multiple relays, which aggregate blocks from multiple builders and submit the most profitable block to the validators.

The concept of PBS was already being researched before The Merge to increase censorship resistance and embrace a more modular future for the network. Implementing PBS pre-Merge was challenging, and The Merge was already a significant upgrade, so an in-protocol PBS wasn't implemented at that time. Hence, the MEV-Boost protocol sidecar was launched by the community to achieve the goal of PBS.

Implications of PBS

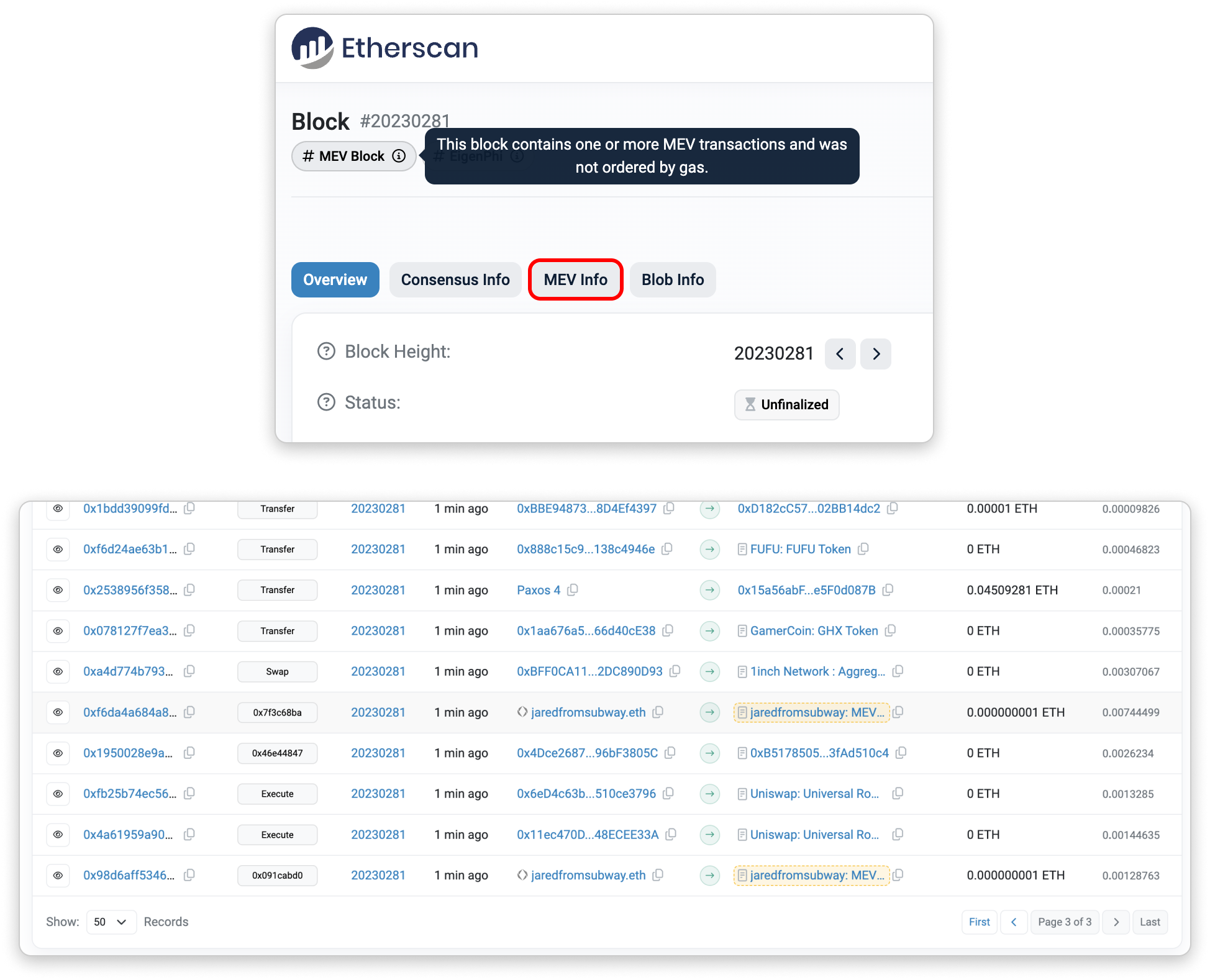

Today, MEV-Boost is so popular that 90% of all Ethereum blocks are built through it. You could go to a random block page on Etherscan and can find that it contains at least one MEV transaction. MEV transactions are sent as bundles by searchers directly to builders, as opposed to most user transactions that go straight to the public mempool.

Ethereum is a dark forest for sure, as your pending transactions are constantly being monitored and waiting to be exploited. Which is why 30% of all confirmed transactions today go through private mempools to shield from MEV. Currently, certain MEV-protected transactions sent via integrated partners are searchable on Etherscan.

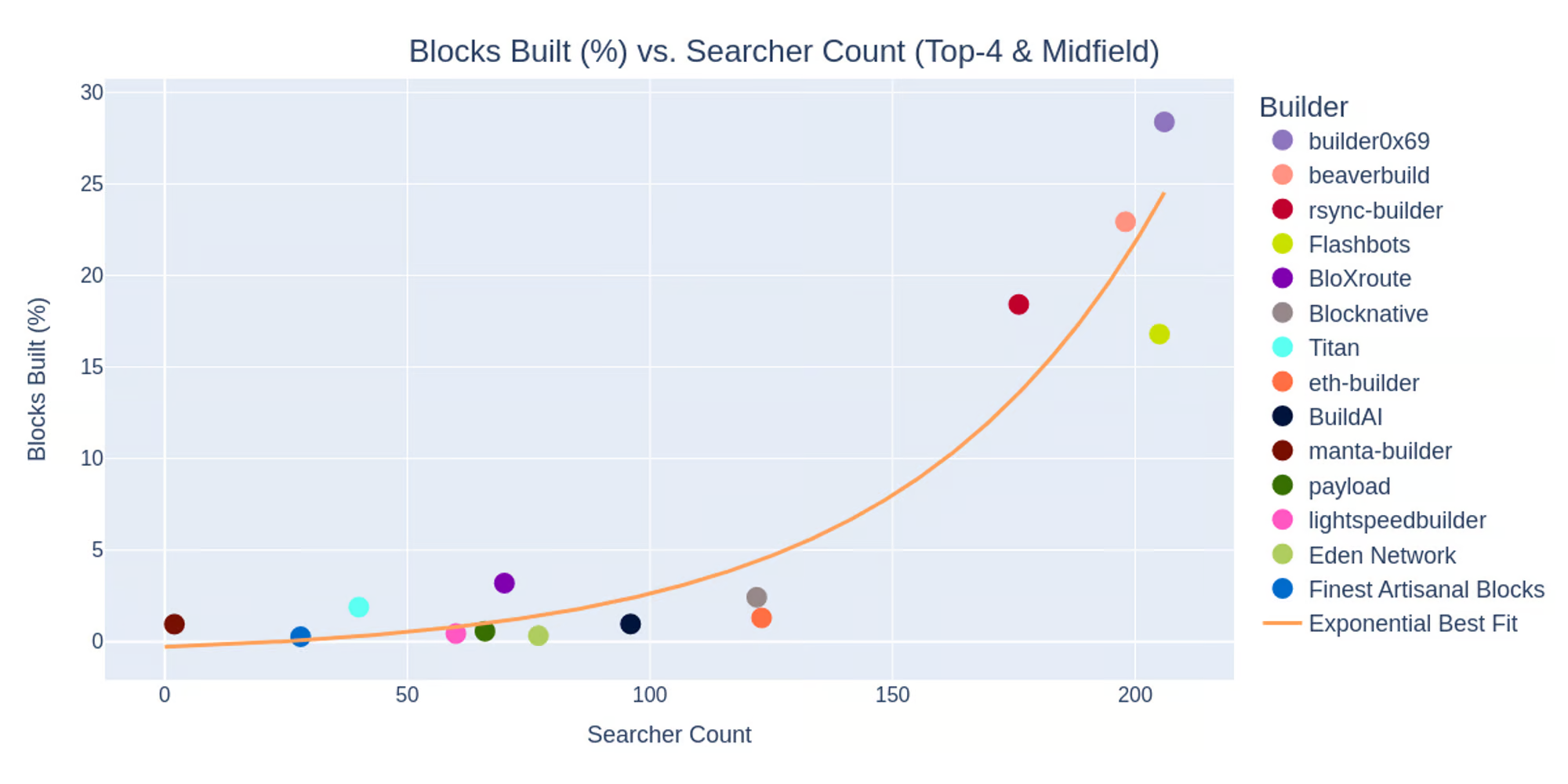

The total realized extractable value since merge exceeded 500k ETH, and 2,781 ETH was extracted in the past 30 days (at time of writing). Validators using MEV-Boost earn an APY of 3.29% compared to 2.93% for those who don't. These higher profits may result from economies of scale in the builder market. Builders that attract more searchers to submit MEV bundles have more permutations of bundle ordering and may, in turn, extract more value in each block.

As builders gain more market share, searchers tend to prefer submitting MEV bundles to them more. This may be due to a higher chance for their bundles to be included in Ethereum blocks and a higher perceived reputation that the MEV bundles are safer with these builders. This potentially restricts the ability of new builders to gain traction and further concentrates builder market share among a few leading builders.

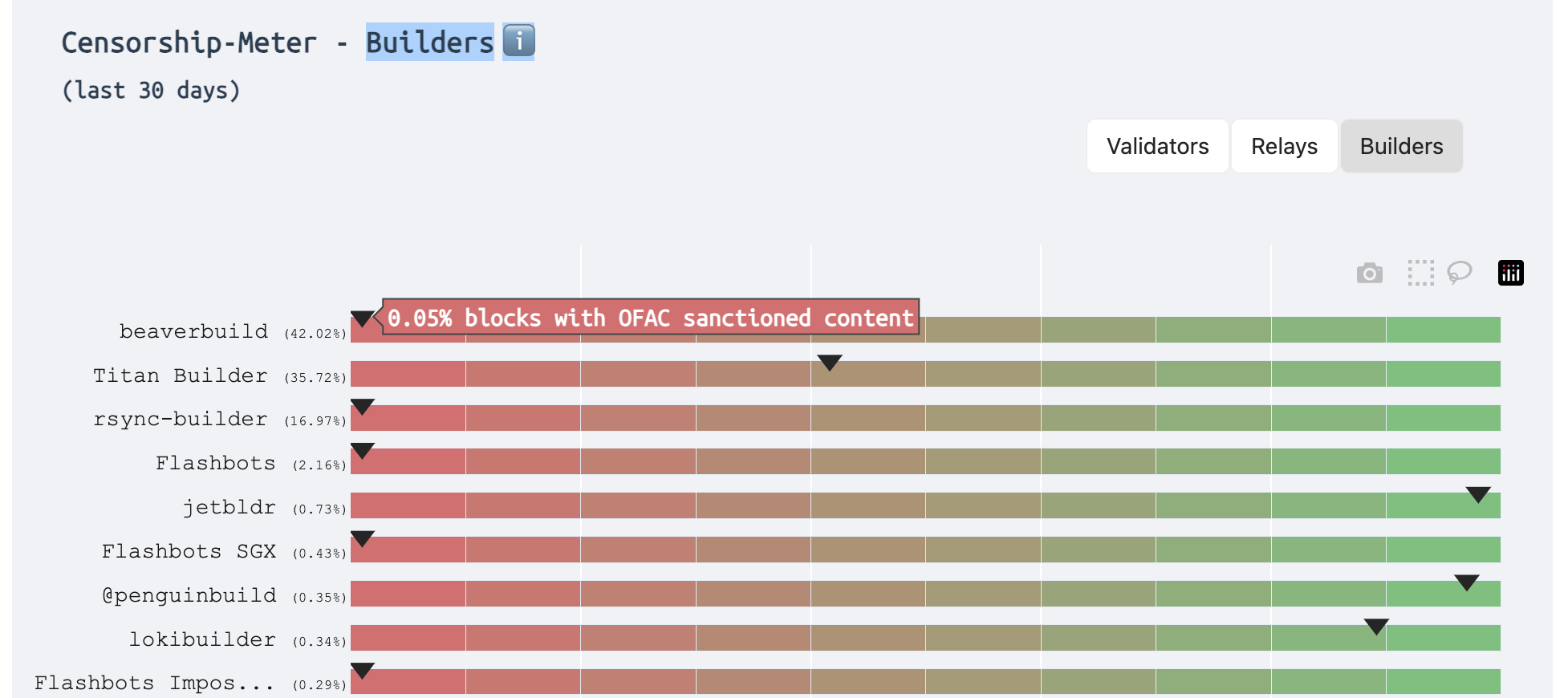

Evidently, the top builder produces ~45% of all blocks in the past 30 days (at time of writing). 2 of the top 4 builders, beaverbuild & rsync-builder, with a combined market share of ~60%, are censoring OFAC-sanctioned transactions.

With the MEV supply chain operating efficiently using low latency performant node infrastructure to propagate blocks, timing games has become an emergent trend. Validators strategically delay their block request from MEV-Boost relays until the last moment while still ensuring blocks get included onchain. This allows more time for MEV rewards to accumulate within a block, granting validators more profits. Less efficient validators with higher latency will find it hard to win in these timing games.

Hot Topics Related to PBS

The current PBS mechanism exists as a protocol sidecar and requires trust assumptions in actors like block builders & MEV relays due to their centralizing tendencies and the potential to censor transactions. These are evident today, as builders are excluding transactions that are OFAC-sanctioned.

One widely discussed solution is Inclusion Lists (IL). The motivation is simple: it allows validators to specify transactions that must go into subsequent blocks to be considered valid. The current reality is that validators are far less likely to censor transactions than builders. Builders can still reorder transactions to their favor, but they must include transactions specified in the IL, thereby removing builders' ability to censor transactions entirely.

With 90% of blocks being constructed through MEV-Boost, it's clear that a validator's primary task today consists of attesting to Ethereum blocks and running sophisticated machines to construct blocks. The ongoing research discussions on Execution Tickets (ET) formally decouple these tasks by introducing the role of an Execution Proposer that purchases block proposal rights in the form of lottery tickets directly from the Ethereum protocol. The full price of the ticket will be burned, allowing more MEV to be captured by the protocol.

ET simplifies the tasks of validators to focus on attesting the chain and constructing an inclusion list of transactions. Validators' earnings are confined to consensus duties, thereby increasing predictability of validator rewards. Whereas the rewards for execution proposers are transaction priority fees and captured MEV. This protects the decentralized validator set from the centralizing forces such as timing games, MEV-smoothing, and proposer-builder vertical integration.

Despite being frequently mentioned on Crypto Twitter, exact implementations of ET are still being explored, with open questions around 1) Pricing & market structure of ET, 2) Secondary market for ET, and 3) Multi-block MEV from entities controlling consecutive slots.

There's also an ongoing biweekly breakout call to discuss the topic of enshrining the PBS (ePBS) mechanism into the Ethereum protocol, which will remove the MEV relayer as a trusted intermediary. One concern about ePBS is if proposers and builders will bypass the enshrined protocol and continue to rely on the relays or other out-of-protocol solutions. But further research shows that using relayers on top of ePBS will have higher latency than utilizing ePBS alone.

Closing Thoughts

Since The Merge, the sustained use of MEV-Boost allowing validators to outsource block building to specialized entities shows a clear opportunity to separate block proposing duties from validating the chain. We're also able to see the reality of centralizing tendencies in block production, prompting researchers to explore meaningful ways to separate it from validator duties while keeping trust assumptions at bay.

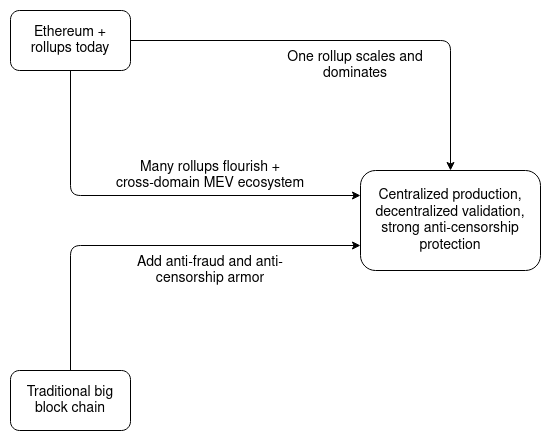

This aligns with the endgame vision that Vitalik famously laid out: "Block production is centralized, block validation is trustless and highly decentralized, and censorship is still prevented."

There are currently many research areas revolving around PBS, but the implementation of stronger anti-censorship protection mechanisms remains to be seen. Until then, Ethereum will continue producing blocks and remain a reliable settlement layer where people want to transact onchain.