Disclaimer: The information in this article is for educational purposes only and should not be taken as financial advice. Always verify details independently before making any financial decision, as market conditions may have changed since publication.

Decentralized Finance (DeFi) has come a long way from its early days of token swaps and experimental protocols. It is now a living, open financial system where your assets can work for you directly on the blockchain.

Even Ethereum co-founder Vitalik Buterin recently highlighted this shift. He wrote that the future of Ethereum depends on “low-risk DeFi”, which includes lending and stablecoin savings that generate steady returns from real economic activity instead of speculation.

That is what onchain yield looks like today, less about hype and more about earning through participation.

When you first explore onchain yield, it is easy to get lost in the buzzwords: staking, LPing, farming, vaults, points. But beneath the noise, most yield opportunities come from a few simple and transparent mechanics. Understanding these helps you see where returns actually come from and what risks you are taking on.

Let’s start with three common categories in DeFi: staking, lending, and liquidity provision.

1) Lending and Borrowing

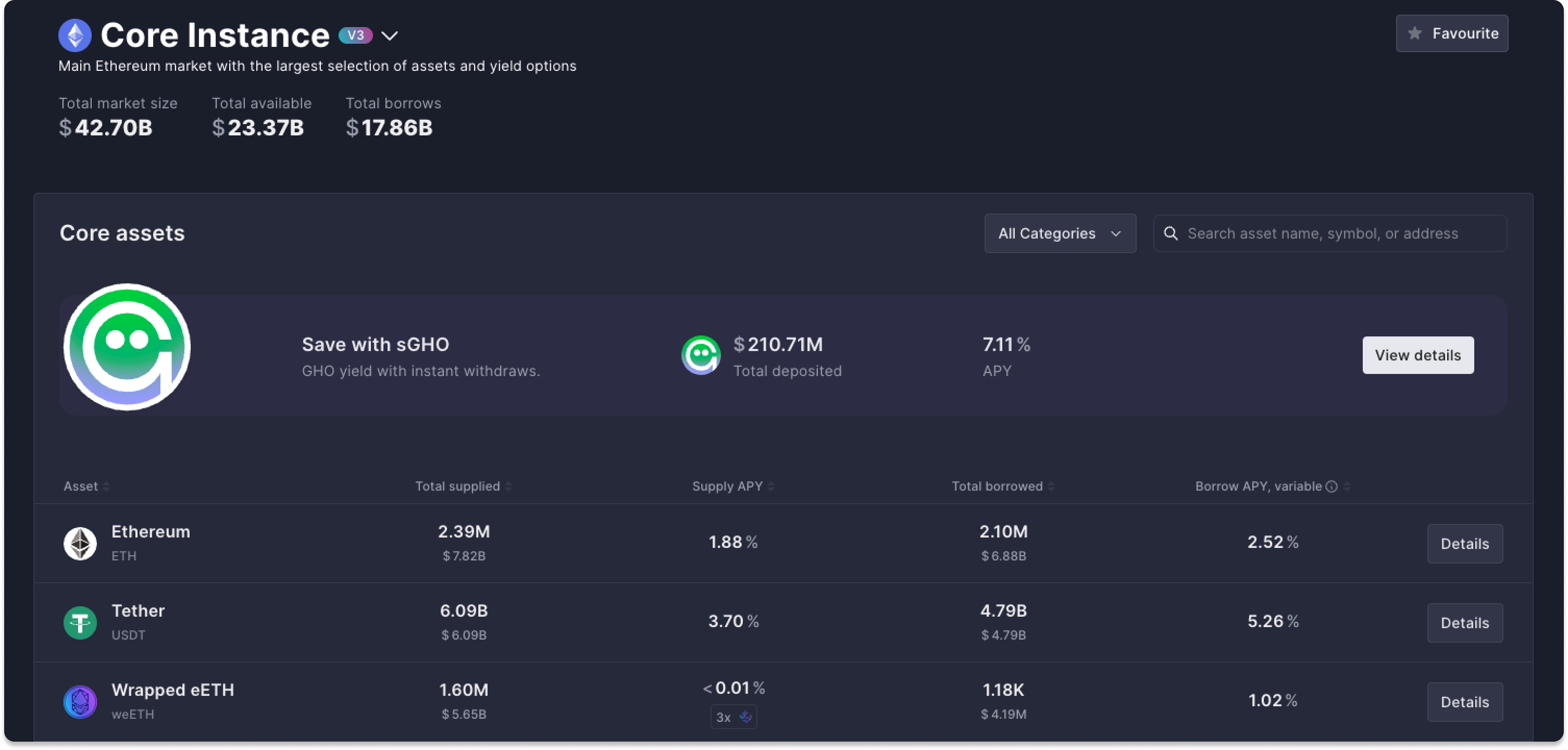

DeFi lending markets such as Aave and Compound allow users to supply assets for others to borrow, all through smart contracts. The yield you earn comes from borrowers paying interest to use your capital. Interest rates adjust dynamically based on supply and demand. When more users borrow, utilization and yields rise. When demand cools, rates fall.

This mirrors traditional money markets but with greater onchain transparency. You can see total deposits, borrow volumes, and live interest rates directly through the protocol interface or a block explorer like Etherscan.

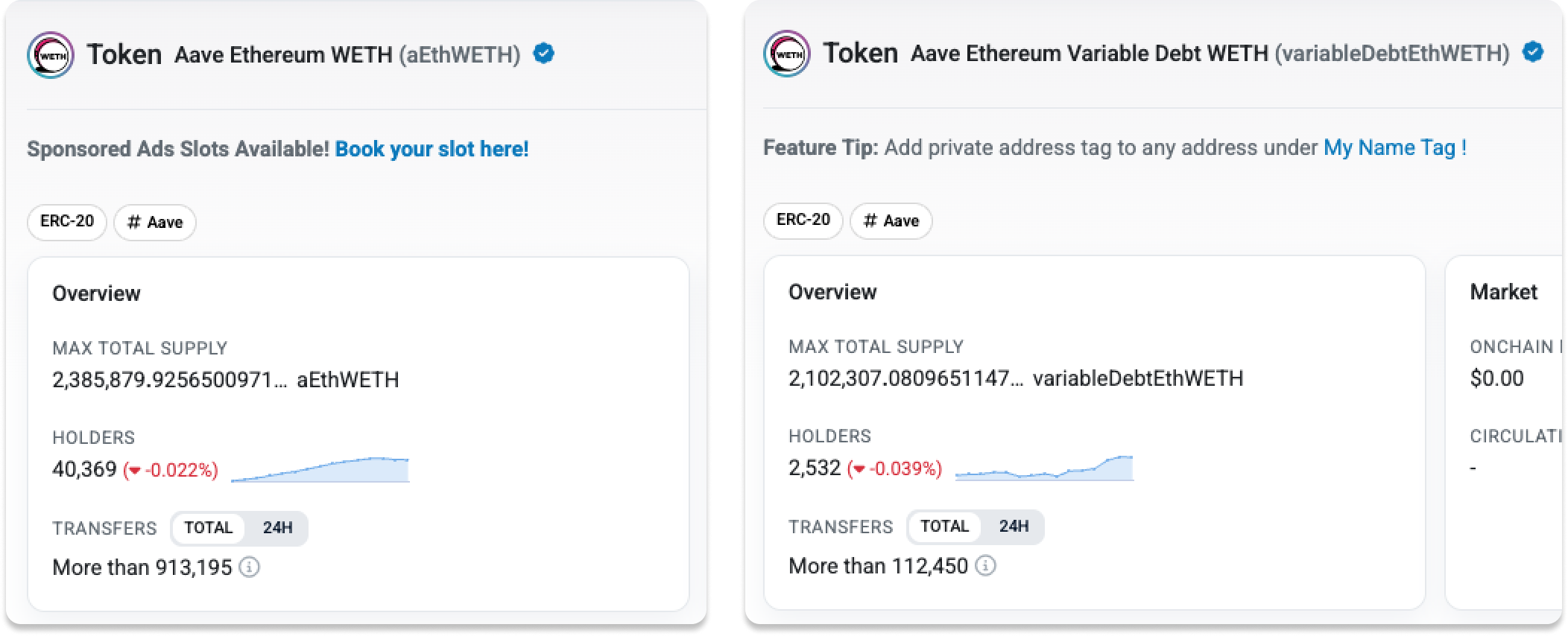

On Etherscan, Aave lending activities appear as aTokens (representing supplied assets) and debt tokens (representing borrowed assets). For example, Aave ETH reserves show around $7.92B supplied and $6.98B borrowed, all verifiable onchain.

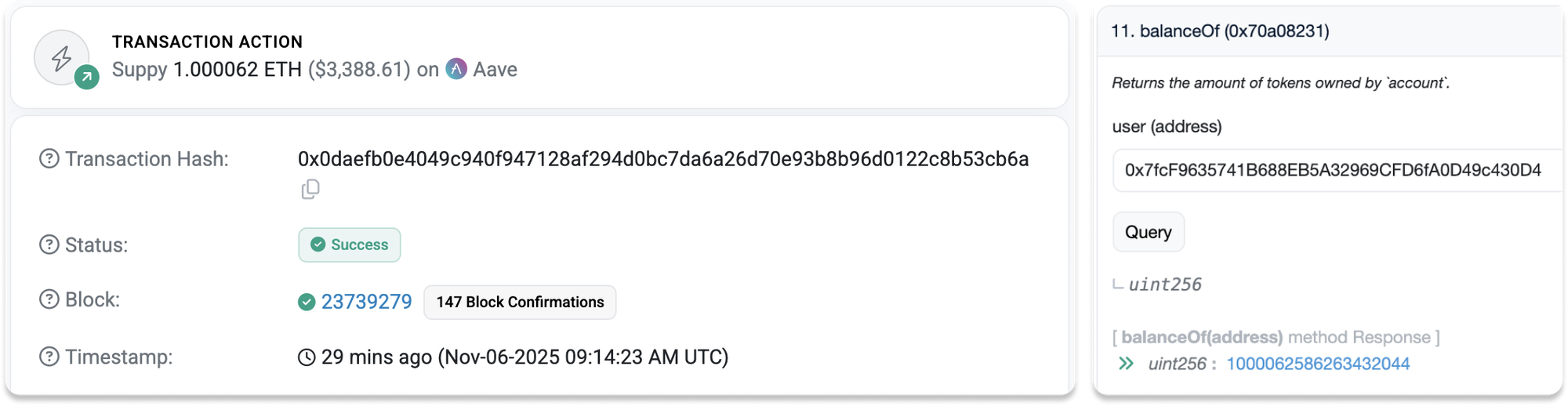

If you have supplied ETH to Aave and want to confirm your position, you can read your balance directly from the contract’s balanceOf function on Etherscan.

You can also use your supplied assets as collateral to borrow other tokens. Some users borrow stablecoins to provide liquidity on DEXs such as Uniswap, effectively stacking multiple layers of yield, but this introduces additional risk.

Borrowing exposes you to liquidation risk if the value of your collateral falls. The protocol may automatically sell your assets to cover the debt. There is also smart contract, oracle, and governance risk, where bugs or bad parameters could impact solvency or user positions.

If you’d like to learn more about DeFi lending, explore resources from protocols such as Aave, Morpho, and Euler. You can also try Fluid, which offers a simulation mode that lets you experiment with lending features using test balances.

2) Liquidity Provision

Liquidity provision powers decentralized exchanges (DEXs). Instead of order books, DEXs use automated market makers (AMMs) that rely on token pools supplied by users. When traders swap tokens, they pay a small fee that is shared among liquidity providers. This is the main source of LP yield, a share of the trading fees generated by the market.

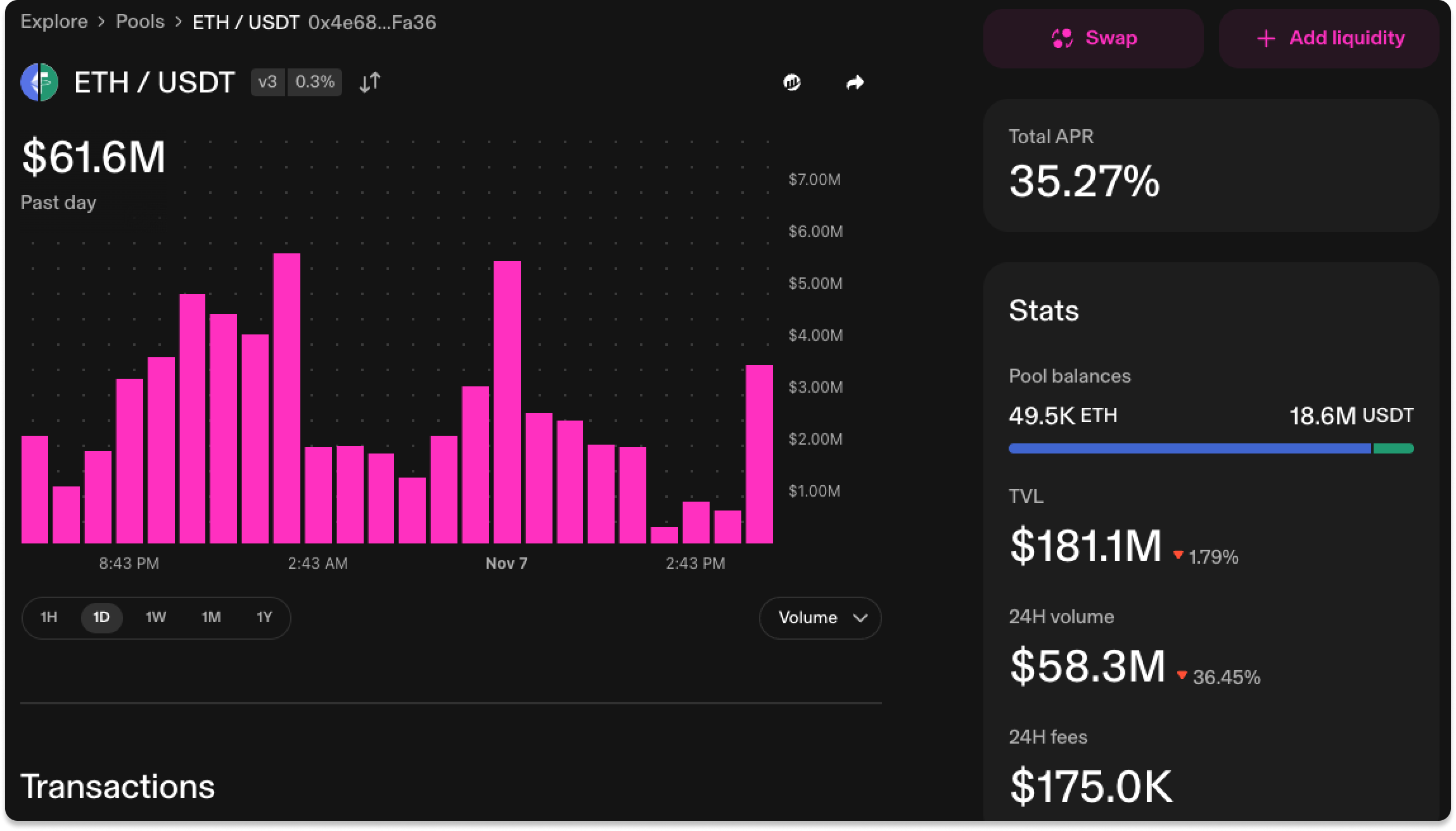

Returns vary depending on trading volume, fee structure, and pool choices, among others. For example, on Uniswap, the ETH/USDT v3 pool currently offers around 35.27% APR at a 0.3% fee tier. On the other hand, the WBTC/USDC v3 pool offers 22.77% total APR at a 0.3% fee tier.

When you provide liquidity to a Uniswap v3 pool, you mint an NFT (LP token) that represents your position, including your chosen price range and fee tier. This customization lets you target higher fee capture during specific market conditions.

Some protocols such as Curve Finance offer extra rewards to attract liquidity. By staking your LP tokens, you can earn CRV tokens on top of trading fees and even lock CRV for up to 2.5× boosted rewards.

However, providing liquidity also exposes you to price changes and impermanent loss. Impermanent loss happens when the price of assets changes after you put them in a liquidity pool, causing you to lose money compared to just keeping them in your wallet. Some AMMs reduce this risk by offering narrower price ranges or single-sided pools, but there is always a balance between earning trading fees and facing price volatility.

Finematics offers an excellent explainer on how liquidity pools work. If you’d like to dive deeper into providing liquidity on specific protocols, Uniswap, Curve, and Sushi each have clear guides and tutorials to help you get started.

3) Native and Liquid Staking

Staking is the foundation of onchain yield for Proof-of-Stake (PoS) blockchains. When you stake assets such as ETH, you help secure the network by locking tokens into validator nodes that process transactions on the network. In return, you earn rewards from block proposals, attestations, and priority fees. These are protocol-level incentives that compensate participants for maintaining network security.

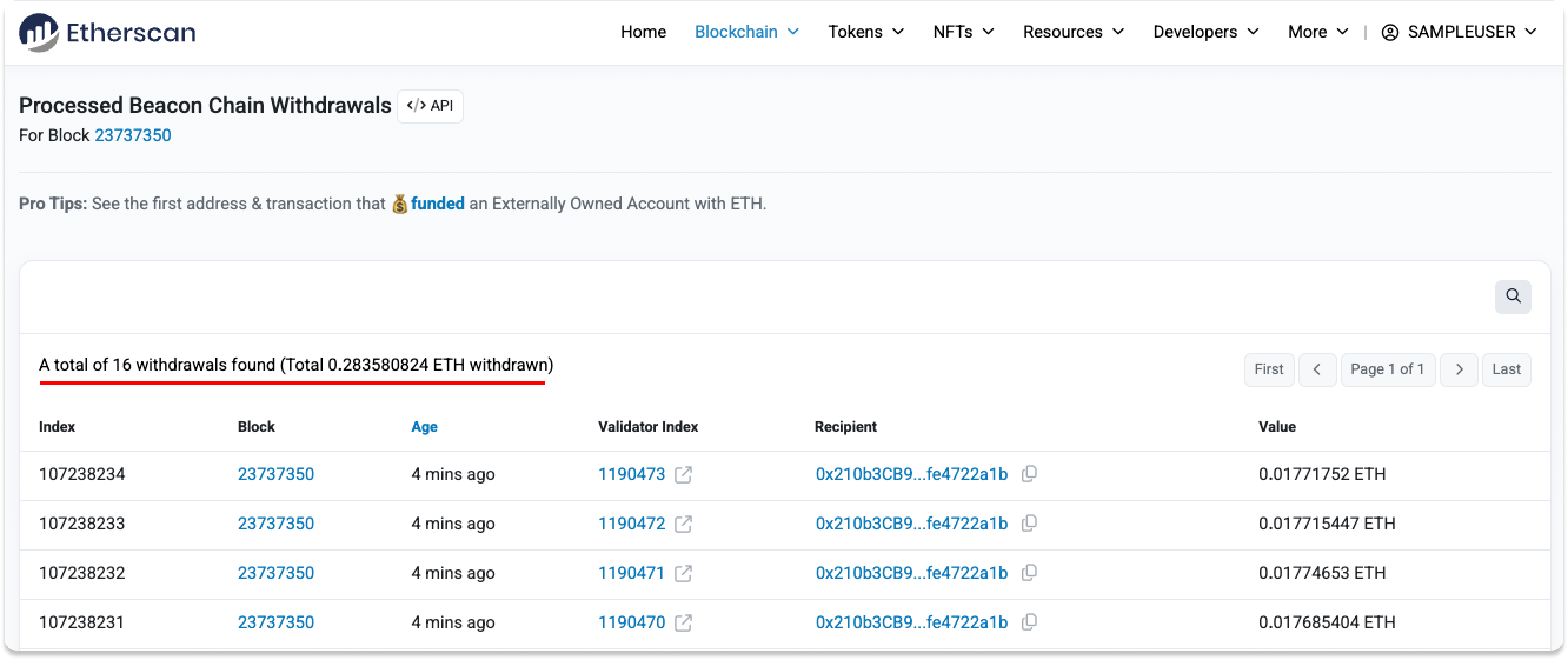

A solo validator requires 32 ETH to participate. Rewards, processed via the Beacon Chain, are automatically withdrawn to your wallet. You can verify these withdrawals on Etherscan.

At the time of writing, solo staking yields around 3% APR, although rates vary depending on total ETH staked, uptime, performance, and slashing. Actual returns also depend on your setup costs, including the initial hardware investment and ongoing expenses like electricity and maintenance.

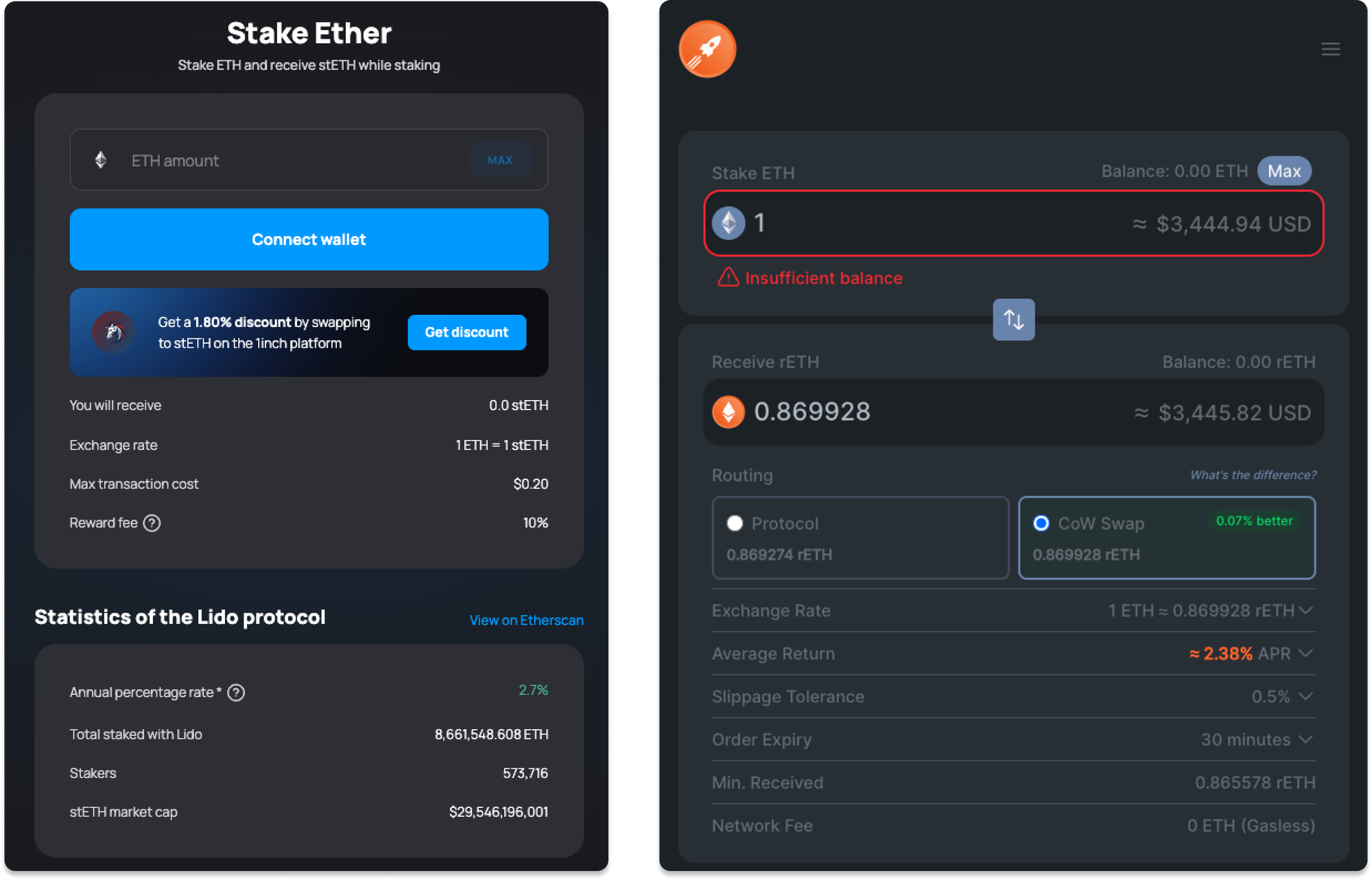

If you prefer convenience, liquid staking options such as stETH (≈2.7% APR) or rETH (≈2.4% APR) allow you to earn staking rewards through a tokenized version of your staked ETH. These liquid staking tokens (LSTs) can also be used in other DeFi protocols, for example as collateral for loans or liquidity provision, allowing you to combine multiple yield sources across the ecosystem.

Staking comes with slashing risk (for validator downtime or misbehavior), depegging risk (for liquid staking tokens), and general contract or governance risk depending on the provider.

If you would like to explore further, EthStaker and Ethereum.org offer detailed guides on both native and liquid staking on Ethereum.

Conclusion

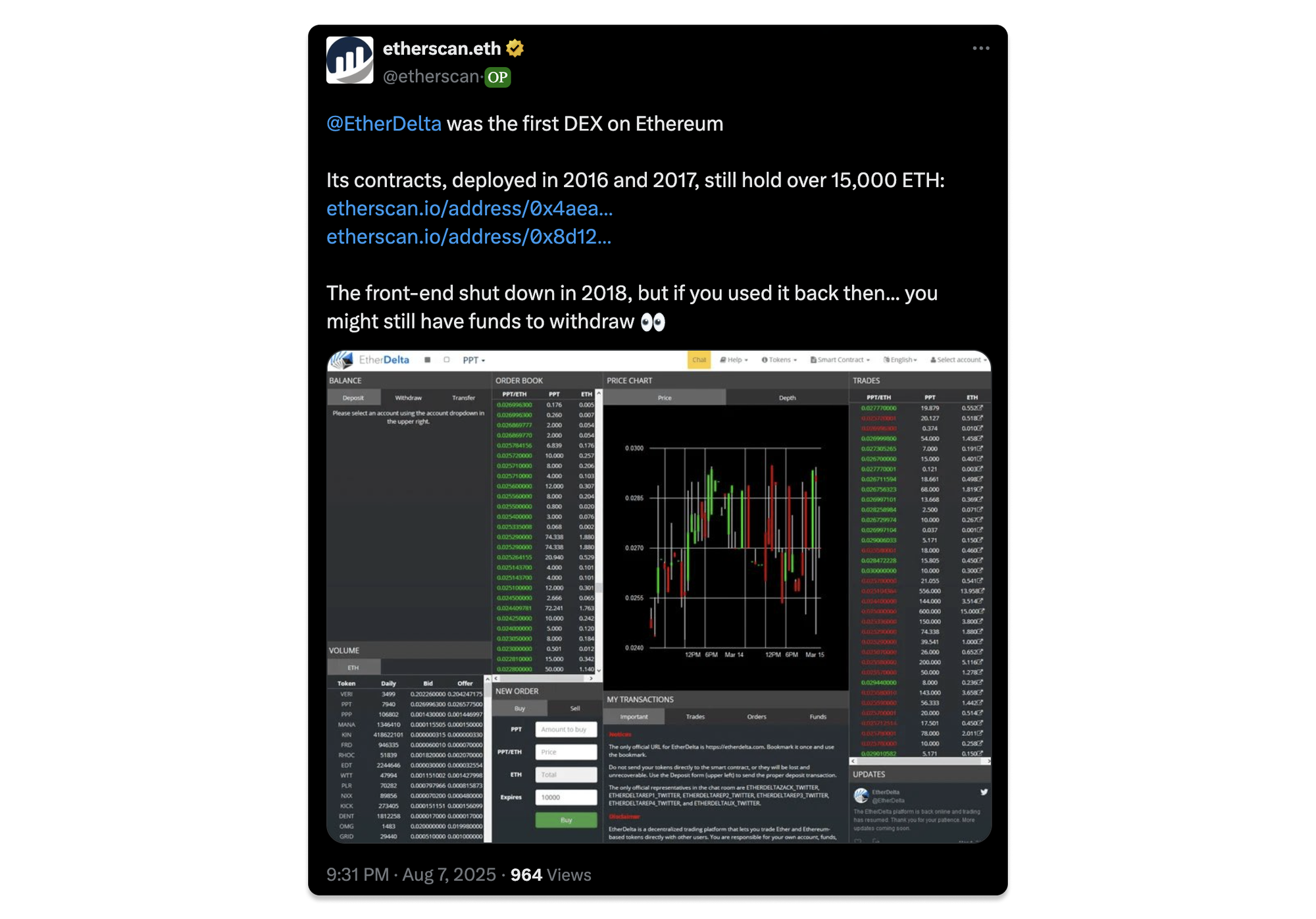

Lending, providing liquidity, and staking ETH are the common ways to earn onchain yield in today’s DeFi landscape. Since 2016, Ethereum’s DeFi ecosystem has matured into a network of interoperable protocols where assets move fluidly and yield can be stacked across multiple layers.

There are also yield tokenization platforms and strategy vaults that use advanced yield mechanics similar to sophisticated traditional finance instruments. If you’d like to dive deeper into the world of DeFi yields, both Galaxy and Crypto Data Bytes offer excellent in-depth analyses, perfect for a weekend read.

However, DeFi yields are not static. Rates fluctuate, incentives change, and risks can surface unexpectedly. Always ask, “Where does this yield come from?” before deploying your capital.

When in doubt, verify contract addresses and transaction data on Etherscan, and practice good onchain hygiene. Awareness and diligence are your best safeguards when putting your capital to work onchain.