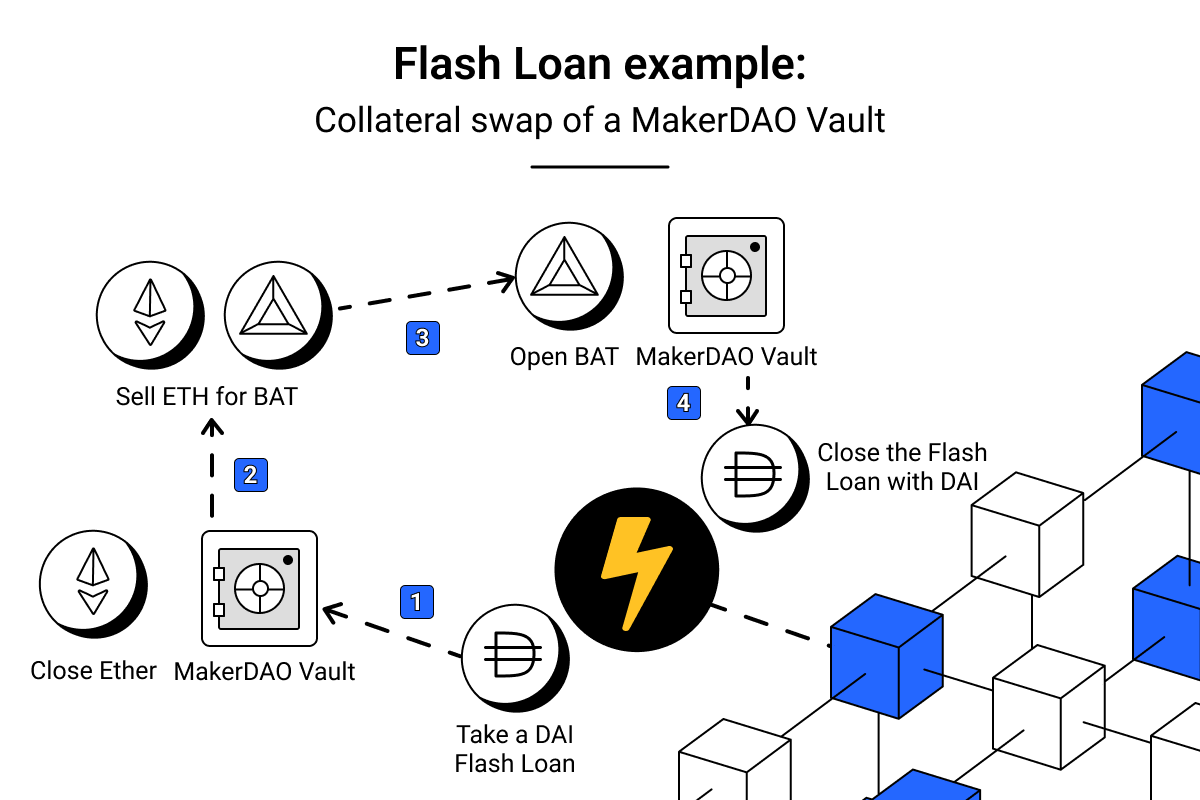

A flash loan is a loan that is borrowed and repaid in the same transaction. It allows users to borrow tokens without providing any collateral and use them for DeFi activities such as arbitrage and liquidation. While flash loans offer a unique opportunity for borrowing without collateral or personal information, they require some technical knowledge to execute and may only be suitable for a subset of traders.

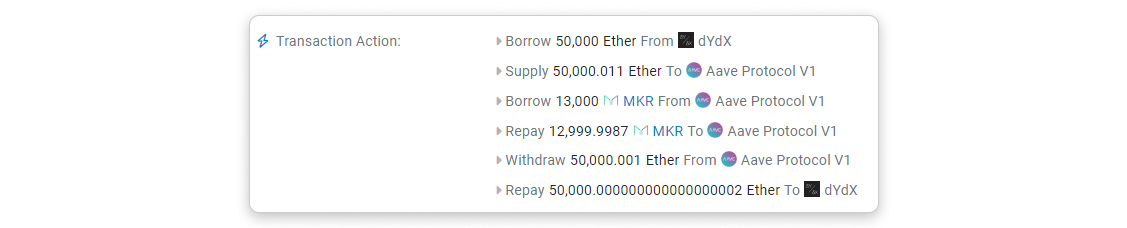

To illustrate how flash loans work in practice, consider the flash vote incident that occurred on MakerDAO. MakerDAO is a decentralized autonomous organization that allows its users to govern its operations and vote on proposals using the MKR token. In this example, a user borrowed 50,000 ETH from the derivatives platform dYdX and used it as collateral to borrow 13,000 MKR from the lending platform Aave. The user then used the MKR tokens to vote on a proposal and quickly repaid the borrowed tokens and all the ETH, with a small percentage of fees.

By leveraging the atomicity of transactions on Ethereum, flash loans enable users to perform multiple actions in a single transaction, as long as the transaction time does not exceed the block time. This makes flash loans a powerful tool for traders with the necessary technical skills and knowledge.